Introduction: Navigating the Global Market for distribution of oil

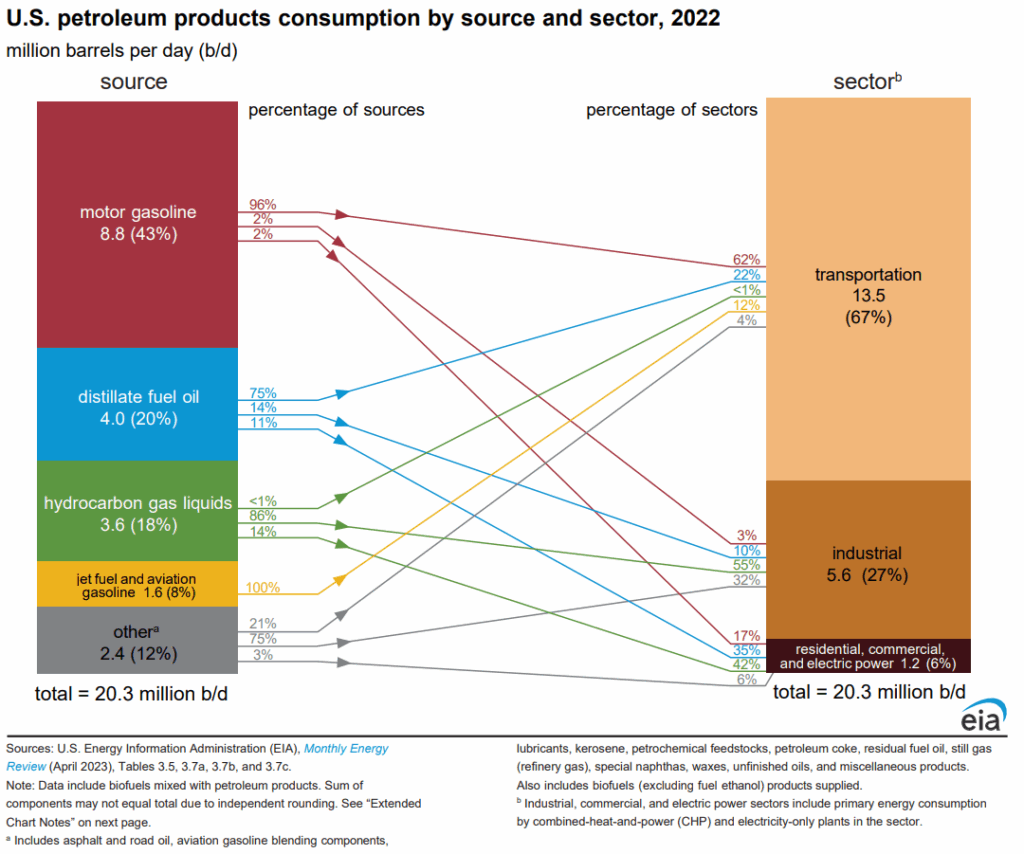

Navigating the complex landscape of oil distribution presents a significant challenge for international B2B buyers, particularly those operating in regions rich in energy resources like Africa, South America, the Middle East, and Europe. With fluctuating prices, varying regulations, and geopolitical influences, sourcing reliable oil supply can feel daunting. This guide aims to demystify the distribution of oil by providing in-depth insights into various types of oil, their applications, and the intricacies involved in supplier vetting. By addressing critical factors such as cost structures, logistical considerations, and market trends, we equip decision-makers with the knowledge necessary to make informed purchasing decisions.

Understanding the global market dynamics is essential for businesses seeking to optimize their oil procurement strategies. With proven reserves concentrated in a handful of countries, such as Saudi Arabia and Brazil, navigating the geopolitical landscape is vital for securing favorable contracts. This comprehensive guide not only outlines the best practices for sourcing oil but also highlights the importance of building relationships with trustworthy suppliers. By leveraging this resource, B2B buyers can enhance their operational efficiency, mitigate risks, and ultimately drive their business success in the ever-evolving energy sector.

Table Of Contents

- Top 3 Distribution Of Oil Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for distribution of oil

- Understanding distribution of oil Types and Variations

- Key Industrial Applications of distribution of oil

- 3 Common User Pain Points for ‘distribution of oil’ & Their Solutions

- Strategic Material Selection Guide for distribution of oil

- In-depth Look: Manufacturing Processes and Quality Assurance for distribution of oil

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘distribution of oil’

- Comprehensive Cost and Pricing Analysis for distribution of oil Sourcing

- Alternatives Analysis: Comparing distribution of oil With Other Solutions

- Essential Technical Properties and Trade Terminology for distribution of oil

- Navigating Market Dynamics and Sourcing Trends in the distribution of oil Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of distribution of oil

- Strategic Sourcing Conclusion and Outlook for distribution of oil

- Important Disclaimer & Terms of Use

Understanding distribution of oil Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Conventional Oil | Extracted from large reservoirs; high recovery rates | Fuel production, petrochemicals | Pros: Established supply chains; high quality. Cons: Volatile pricing; geopolitical risks. |

| Unconventional Oil | Includes shale oil and tar sands; requires advanced extraction techniques | Specialty fuels, lubricants | Pros: Expanding supply; diverse applications. Cons: Higher extraction costs; environmental concerns. |

| Heavy Crude Oil | High density and viscosity; requires upgrading for use | Industrial fuels, asphalt | Pros: Lower production costs; abundant reserves. Cons: Processing complexity; higher transportation costs. |

| Biofuels | Derived from biomass; renewable source | Transportation fuels, energy | Pros: Sustainable; lower carbon footprint. Cons: Limited availability; land use competition. |

| Synthetic Crude Oil | Created from natural gas or coal; tailored properties | Specialty chemicals, fuels | Pros: Customizable; stable supply. Cons: High production costs; energy-intensive processes. |

What Are the Key Characteristics of Conventional Oil?

Conventional oil is extracted from large reservoirs using traditional drilling methods, characterized by high recovery rates and well-established production techniques. Its primary applications include fuel production and petrochemical manufacturing. For B2B buyers, the advantages lie in its reliable supply chains and high-quality outputs, although they must navigate the challenges of volatile pricing influenced by geopolitical factors.

How Does Unconventional Oil Differ from Conventional Oil?

Unconventional oil encompasses resources such as shale oil and tar sands, which require advanced extraction methods like hydraulic fracturing or thermal recovery. This type of oil is increasingly important for specialty fuels and lubricants. Buyers benefit from an expanding supply and diverse applications; however, they must consider higher extraction costs and potential environmental impacts, which can affect public perception and regulatory compliance.

What Are the Implications of Heavy Crude Oil for Buyers?

Heavy crude oil is characterized by its high density and viscosity, necessitating upgrading processes before it can be refined into usable products. It is primarily used in industrial fuels and asphalt production. Buyers may find lower production costs and abundant reserves appealing, but they should also be aware of the complexities involved in processing and the higher transportation costs associated with its movement to refineries.

Why Are Biofuels Considered an Important Alternative?

Biofuels are derived from biomass and represent a renewable energy source, making them increasingly relevant in discussions about sustainability. They are primarily used as transportation fuels and in energy production. The benefits for B2B buyers include a lower carbon footprint and alignment with corporate sustainability goals. However, buyers should consider the limitations in availability and potential competition for land use, which could impact supply chains.

What Are the Benefits and Challenges of Synthetic Crude Oil?

Synthetic crude oil is produced from natural gas or coal through processes that create tailored properties for specific applications. This type of oil is mainly used in specialty chemicals and fuels. The key advantages for buyers include a customizable product and stable supply, which can be crucial for long-term planning. However, the high production costs and energy-intensive processes involved in its creation can pose significant challenges, particularly in price-sensitive markets.

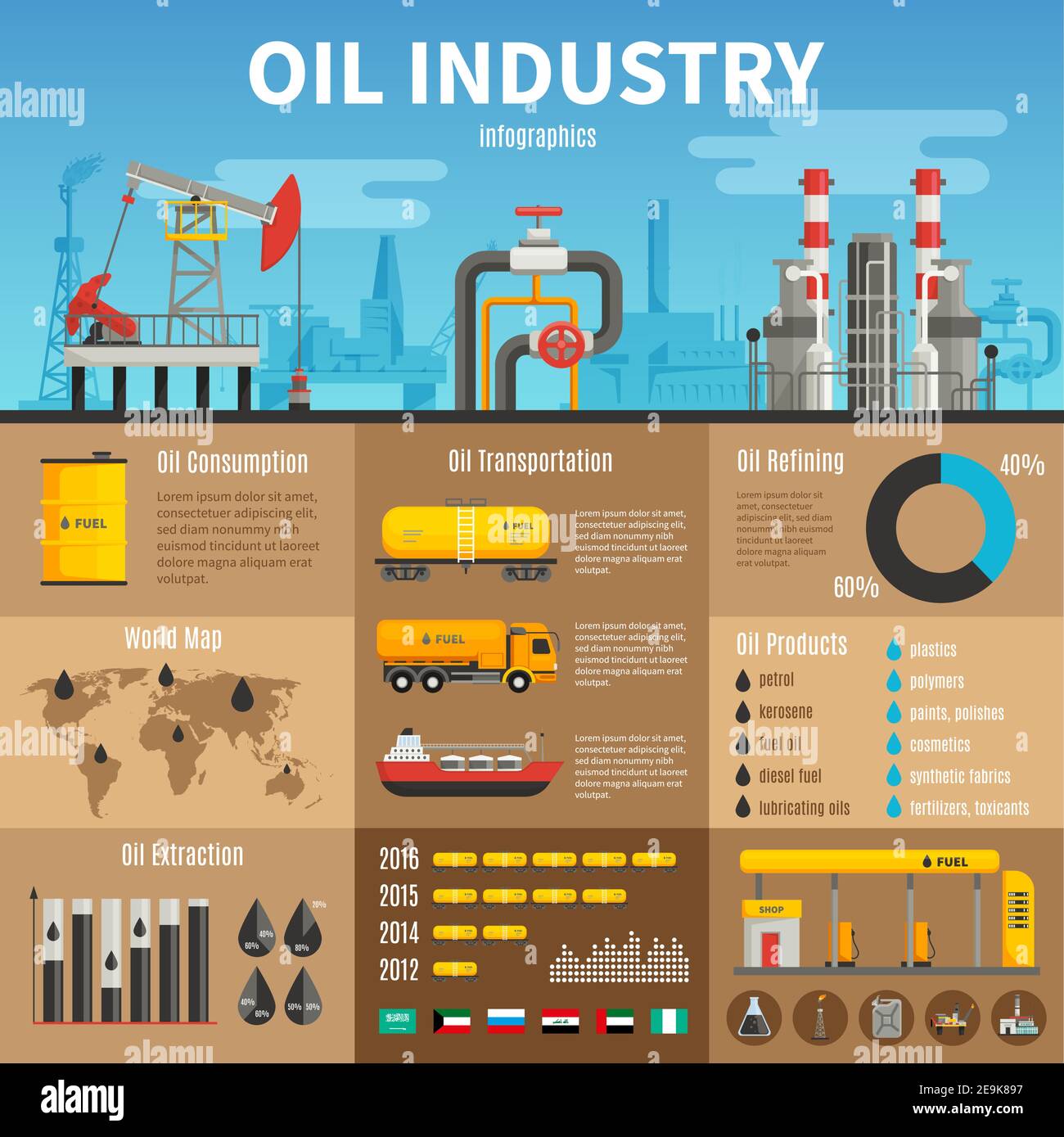

Key Industrial Applications of distribution of oil

| Industry/Sector | Specific Application of distribution of oil | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Transportation | Fuel supply for commercial shipping | Ensures reliable fuel availability, reducing operational delays | Quality assurance, logistics capabilities, and regional regulations |

| Manufacturing | Feedstock for petrochemical production | Enables production of essential materials like plastics and chemicals | Consistency in supply, pricing stability, and environmental compliance |

| Energy Production | Crude oil for refining into various fuels | Diversifies energy portfolio and enhances energy security | Supplier reliability, geopolitical stability, and refining capacity |

| Agriculture | Fuel for agricultural machinery and equipment | Increases operational efficiency and productivity in farming | Availability of diesel or biodiesel, and competitive pricing |

| Construction | Fuel for heavy machinery and equipment | Facilitates timely project completion and operational efficiency | Bulk supply agreements, delivery schedules, and quality standards |

How is Oil Distributed in the Transportation Sector?

In the transportation industry, the distribution of oil is primarily focused on supplying fuel for commercial shipping. With the global economy relying heavily on maritime trade, ensuring a consistent and reliable fuel supply is critical. Companies need to consider logistics capabilities and compliance with regional regulations to avoid operational delays. By partnering with established distributors, businesses can secure a steady flow of fuel, which is vital for maintaining timely deliveries and reducing costs.

What Role Does Oil Play in Manufacturing?

Oil serves as a key feedstock in petrochemical production, which is essential for creating various materials such as plastics, fertilizers, and chemicals. The distribution of oil in this sector is crucial for maintaining production cycles and meeting market demands. Buyers need to ensure that their oil suppliers can provide consistent quality and stability in pricing to avoid disruptions in manufacturing processes. Environmental compliance is also becoming increasingly important, as regulations evolve to address sustainability in production.

How is Oil Essential for Energy Production?

In energy production, crude oil distribution is vital for refining processes that convert oil into various fuels and energy products. This diversification helps companies enhance their energy security and meet consumer demands efficiently. Buyers should prioritize supplier reliability and geopolitical stability when sourcing crude oil, as these factors significantly impact pricing and availability. Understanding the refining capacity of suppliers can also help in selecting the right partners for long-term contracts.

How is Oil Used in Agriculture?

The agricultural sector relies on oil for fueling machinery and equipment, making the distribution of oil essential for operational efficiency. Timely access to fuel can significantly enhance productivity in farming, especially during critical planting and harvesting seasons. Buyers need to focus on sourcing diesel or biodiesel that is readily available and competitively priced. Establishing long-term relationships with suppliers can also help in securing favorable pricing and delivery schedules.

Why is Oil Important for the Construction Industry?

In construction, the distribution of oil is critical for powering heavy machinery and equipment, which are essential for project execution. Reliable fuel supply ensures that projects are completed on time and within budget, enhancing overall operational efficiency. Buyers should consider bulk supply agreements to manage costs effectively and ensure that quality standards are met. Timely delivery schedules are also crucial to prevent project delays and maintain productivity on-site.

3 Common User Pain Points for ‘distribution of oil’ & Their Solutions

Scenario 1: Unpredictable Supply Chain Disruptions in Oil Distribution

The Problem: B2B buyers in the oil distribution sector often grapple with unpredictable supply chain disruptions. Factors such as geopolitical tensions, natural disasters, or sudden regulatory changes can lead to fluctuations in oil availability. For companies relying on a steady supply of oil for production, these disruptions can halt operations, increase costs, and diminish customer trust. Buyers find themselves in a precarious position where they must react swiftly to secure alternative sources or renegotiate terms, which can result in financial strain and operational inefficiencies.

The Solution: To mitigate the risks associated with supply chain disruptions, buyers should establish a diversified sourcing strategy. This involves identifying multiple suppliers across various regions, particularly focusing on stable markets that are less prone to disruptions. Buyers should also leverage technology for real-time monitoring of global oil prices and supply chain analytics. Implementing a robust risk management plan that includes contingency strategies—such as maintaining strategic reserves or utilizing alternative fuels—can further enhance resilience. Regular communication with suppliers can help anticipate potential disruptions, allowing buyers to proactively adjust their procurement strategies.

Illustrative image related to distribution of oil

Scenario 2: Navigating Complex Regulatory Requirements for Oil Distribution

The Problem: The oil distribution industry is heavily regulated, with various compliance requirements that can vary significantly across different countries and regions. B2B buyers often face challenges in understanding and adhering to these regulations, which can include safety standards, environmental protections, and tariffs. Non-compliance can lead to severe penalties, operational delays, and reputational damage, making it imperative for buyers to stay informed and compliant.

The Solution: To navigate the complex regulatory landscape, B2B buyers should invest in compliance management systems that provide up-to-date information on regulations relevant to their operations. Collaborating with legal experts who specialize in oil and gas law can provide valuable insights into local regulations and help ensure compliance. Additionally, establishing a dedicated compliance team within the organization can streamline the process of monitoring regulatory changes and implementing necessary adjustments. Regular training sessions for employees on compliance best practices will foster a culture of compliance and reduce the risk of inadvertent violations.

Scenario 3: Ensuring Quality Control and Consistency in Oil Supply

The Problem: Quality control is a significant concern for B2B buyers in the oil distribution sector. Variability in oil quality can arise from different suppliers, affecting performance, safety, and customer satisfaction. Buyers often face difficulties in maintaining consistent quality across different shipments, which can lead to operational issues and potential liabilities. Ensuring the quality of oil is particularly critical for industries that rely on specific grades for production processes.

The Solution: To ensure quality control, buyers should implement rigorous supplier evaluation processes that assess not only the price but also the quality of the oil being supplied. This can include requesting detailed specifications, certifications, and quality assurance processes from suppliers. Conducting regular audits and establishing long-term partnerships with reliable suppliers can create a more consistent quality supply chain. Additionally, employing third-party quality testing services can provide an unbiased assessment of the oil before it reaches the buyer’s facilities. By integrating quality assurance protocols into the procurement process, companies can significantly reduce variability and improve overall satisfaction with their oil supply.

Strategic Material Selection Guide for distribution of oil

When selecting materials for the distribution of oil, it is essential to consider various factors that can significantly impact performance, safety, and compliance with international standards. This guide analyzes four common materials used in oil distribution systems: carbon steel, stainless steel, polyethylene, and fiberglass-reinforced plastic (FRP). Each material presents unique properties, advantages, and limitations that must be carefully evaluated by B2B buyers, especially those operating in diverse regions such as Africa, South America, the Middle East, and Europe.

Illustrative image related to distribution of oil

What Are the Key Properties of Carbon Steel in Oil Distribution?

Carbon steel is widely used in oil distribution due to its strength and durability. It typically has a high-temperature and pressure rating, making it suitable for various applications. Its corrosion resistance can be enhanced with protective coatings, though it is generally susceptible to rusting in the presence of moisture. Carbon steel pipes are often preferred for their mechanical properties and ability to withstand high-stress environments.

Pros and Cons: The primary advantage of carbon steel is its cost-effectiveness compared to other materials. However, its susceptibility to corrosion can lead to higher maintenance costs over time. Additionally, the manufacturing complexity can increase if specialized coatings or treatments are required.

Impact on Application: Carbon steel is compatible with a wide range of oil types but may not be suitable for highly corrosive media without additional treatment.

Considerations for International Buyers: Buyers should ensure compliance with standards such as ASTM A106 for seamless carbon steel pipes. In regions like the Middle East and South America, where environmental conditions can vary, additional corrosion protection may be necessary.

How Does Stainless Steel Perform in Oil Distribution Systems?

Stainless steel offers excellent corrosion resistance, making it ideal for oil distribution, especially in harsh environments. Its high-temperature and pressure ratings allow it to be used in various applications, including pipelines and storage tanks. The material’s durability ensures a long lifespan, reducing the need for frequent replacements.

Illustrative image related to distribution of oil

Pros and Cons: The key advantage of stainless steel is its resistance to corrosion and staining, which is crucial in maintaining the integrity of oil products. However, it comes at a higher cost compared to carbon steel, which may deter some buyers. Additionally, the manufacturing process can be more complex, impacting lead times.

Impact on Application: Stainless steel is compatible with a wide range of oil products, including those with corrosive additives. Its non-reactive nature makes it suitable for high-purity applications.

Considerations for International Buyers: Compliance with standards such as ASTM A312 for stainless steel pipes is essential. Buyers in Europe may prefer grades like 316 for enhanced corrosion resistance in marine environments.

Illustrative image related to distribution of oil

What Are the Advantages of Using Polyethylene in Oil Distribution?

Polyethylene (PE) is a lightweight, flexible material commonly used in oil distribution, particularly for underground applications. It has excellent chemical resistance and can withstand a wide range of temperatures and pressures, making it suitable for various oil types.

Pros and Cons: The primary advantage of polyethylene is its resistance to corrosion and low weight, which simplifies installation. However, it is less durable than metals and may not be suitable for high-pressure applications. Additionally, its lower mechanical strength can be a limitation in certain environments.

Impact on Application: Polyethylene is compatible with many oil products but may not be suitable for high-temperature applications.

Considerations for International Buyers: Buyers should verify compliance with international standards such as ASTM D3350. In regions like Africa and South America, where underground installations are common, the flexibility of polyethylene can be beneficial.

Illustrative image related to distribution of oil

Why Choose Fiberglass-Reinforced Plastic (FRP) for Oil Distribution?

FRP is increasingly used in oil distribution due to its lightweight and corrosion-resistant properties. It can handle a wide range of temperatures and pressures, making it suitable for various applications, including storage tanks and pipelines.

Pros and Cons: The key advantage of FRP is its exceptional corrosion resistance and low maintenance requirements. However, it can be more expensive than traditional materials like carbon steel and may require specialized installation techniques.

Impact on Application: FRP is compatible with various oil types and is particularly effective in environments where corrosion is a significant concern.

Considerations for International Buyers: Compliance with standards such as ASTM D3299 is critical for ensuring product quality. Buyers in the Middle East and Europe may find FRP advantageous in coastal areas with high salinity.

Summary Table of Material Selection for Oil Distribution

| Material | Typical Use Case for distribution of oil | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Carbon Steel | Pipelines, storage tanks | Cost-effective and strong | Susceptible to corrosion | Medium |

| Stainless Steel | High-purity applications, pipelines | Excellent corrosion resistance | Higher cost and complex manufacturing | High |

| Polyethylene | Underground pipelines | Lightweight and flexible | Less durable under high pressure | Low |

| Fiberglass-Reinforced Plastic (FRP) | Storage tanks, pipelines | Exceptional corrosion resistance | Higher cost and specialized installation | High |

This comprehensive analysis provides B2B buyers with actionable insights into material selection for oil distribution, enabling informed decisions that align with their operational needs and compliance requirements.

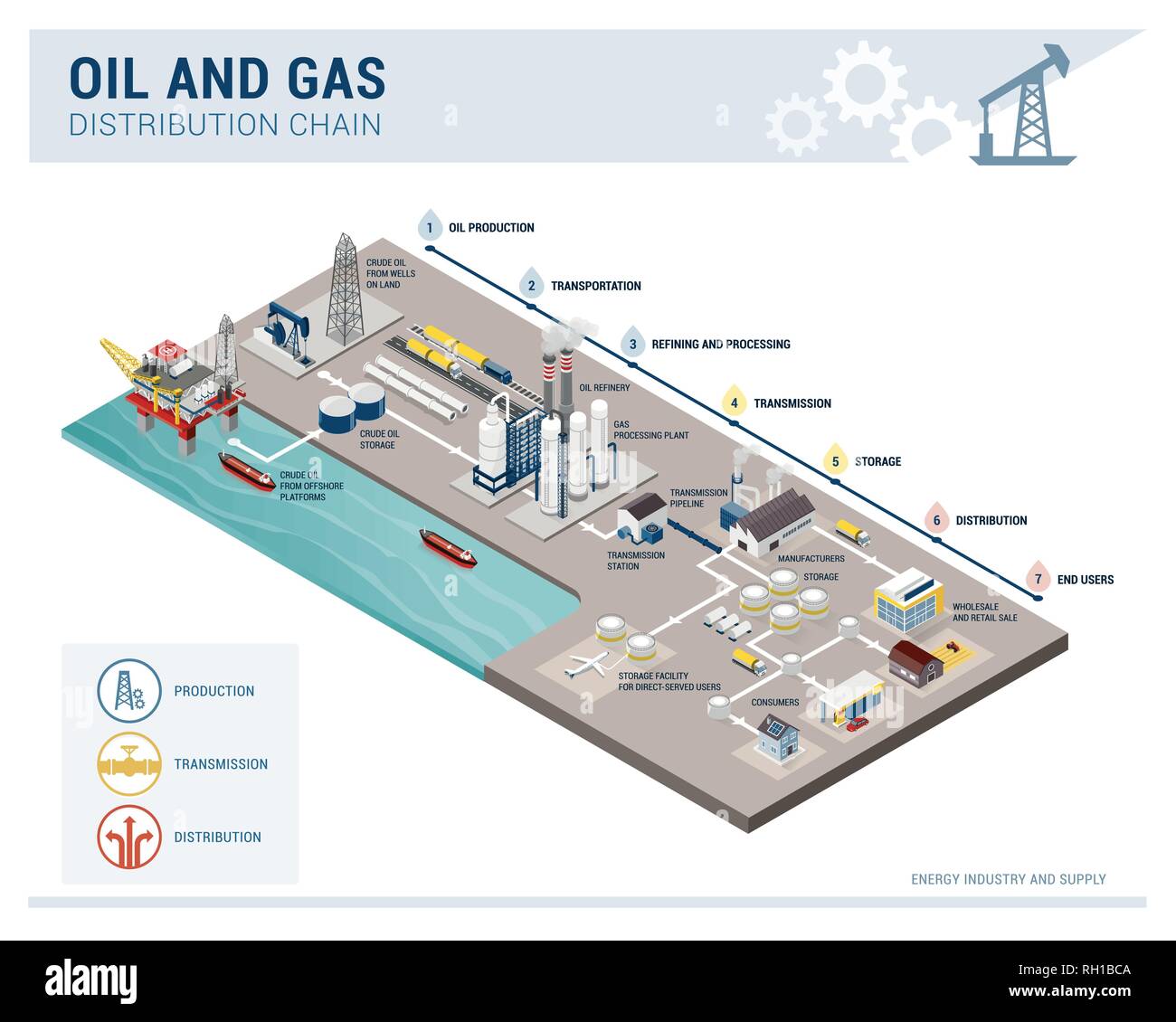

In-depth Look: Manufacturing Processes and Quality Assurance for distribution of oil

What Are the Main Stages in the Manufacturing Process for Oil Distribution?

The manufacturing process for oil distribution involves several critical stages, each designed to ensure the efficient handling and delivery of oil products. Understanding these stages helps B2B buyers assess suppliers’ capabilities and reliability.

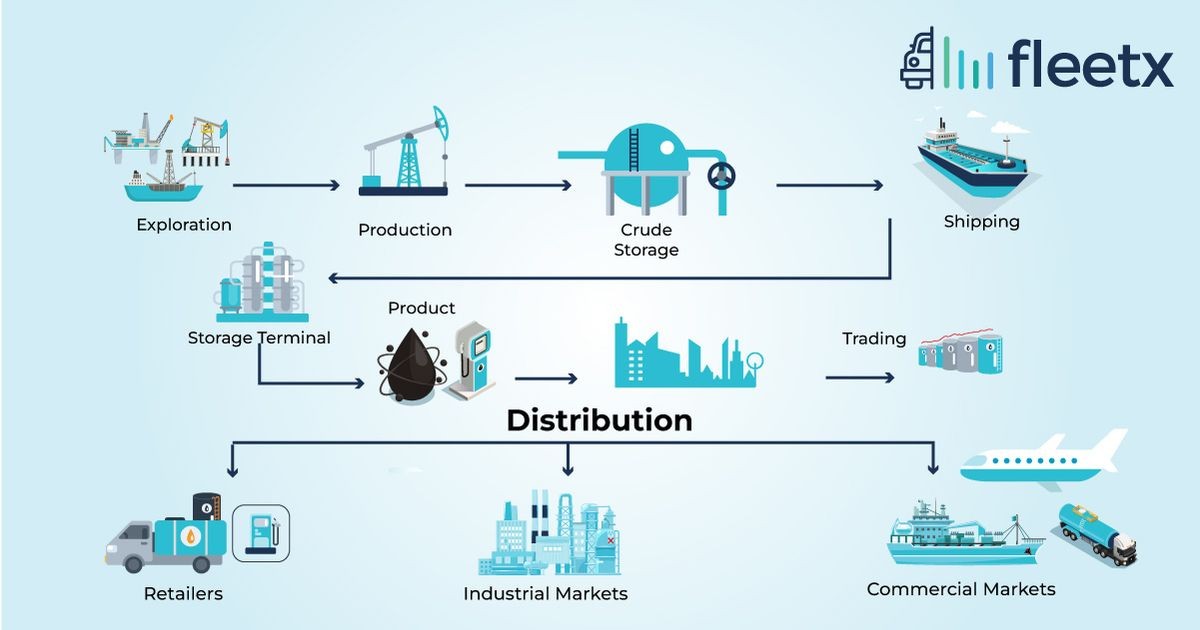

Material Preparation: How Is Oil Prepared for Distribution?

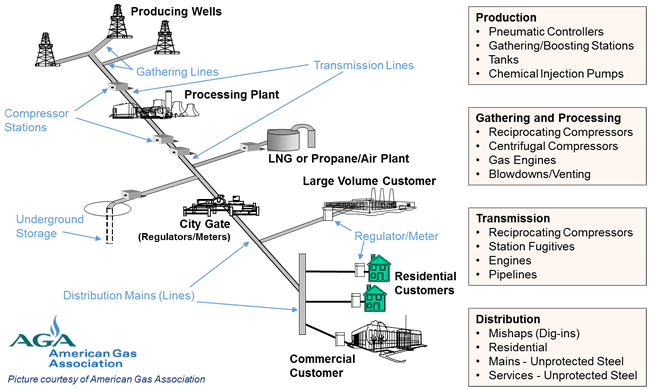

The initial stage involves the careful selection and preparation of raw materials, which primarily includes crude oil and its derivatives. This stage may involve:

- Crude Oil Extraction: Sourced from major fields, crude oil undergoes initial processing to remove impurities. This can include physical separation and treatment to ensure compliance with quality standards.

- Transportation: The oil is transported via pipelines, tankers, or rail to refineries or distribution centers. The method chosen often depends on the geographical location and logistics capabilities.

During this stage, suppliers should adhere to international transportation standards to minimize contamination and ensure the safe delivery of materials.

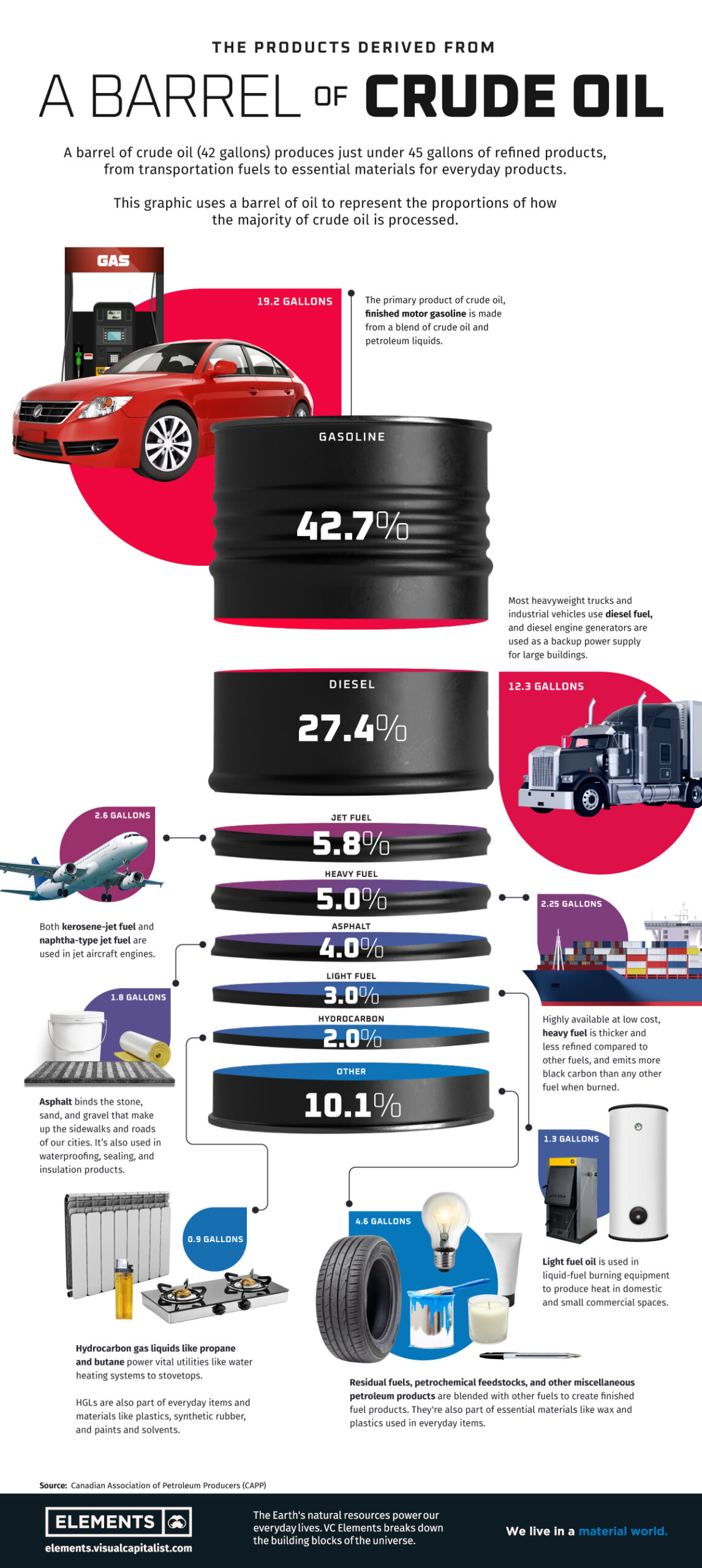

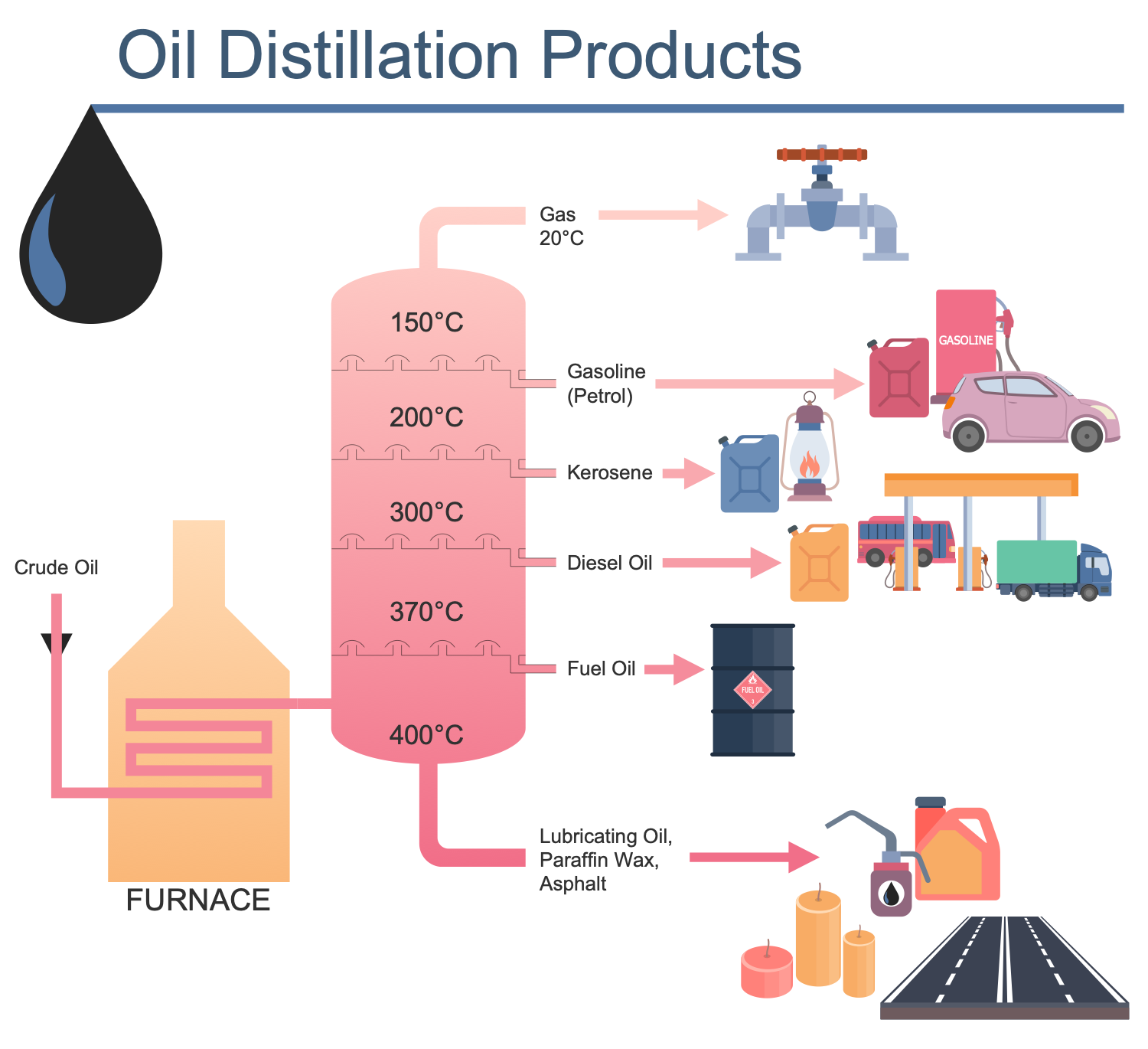

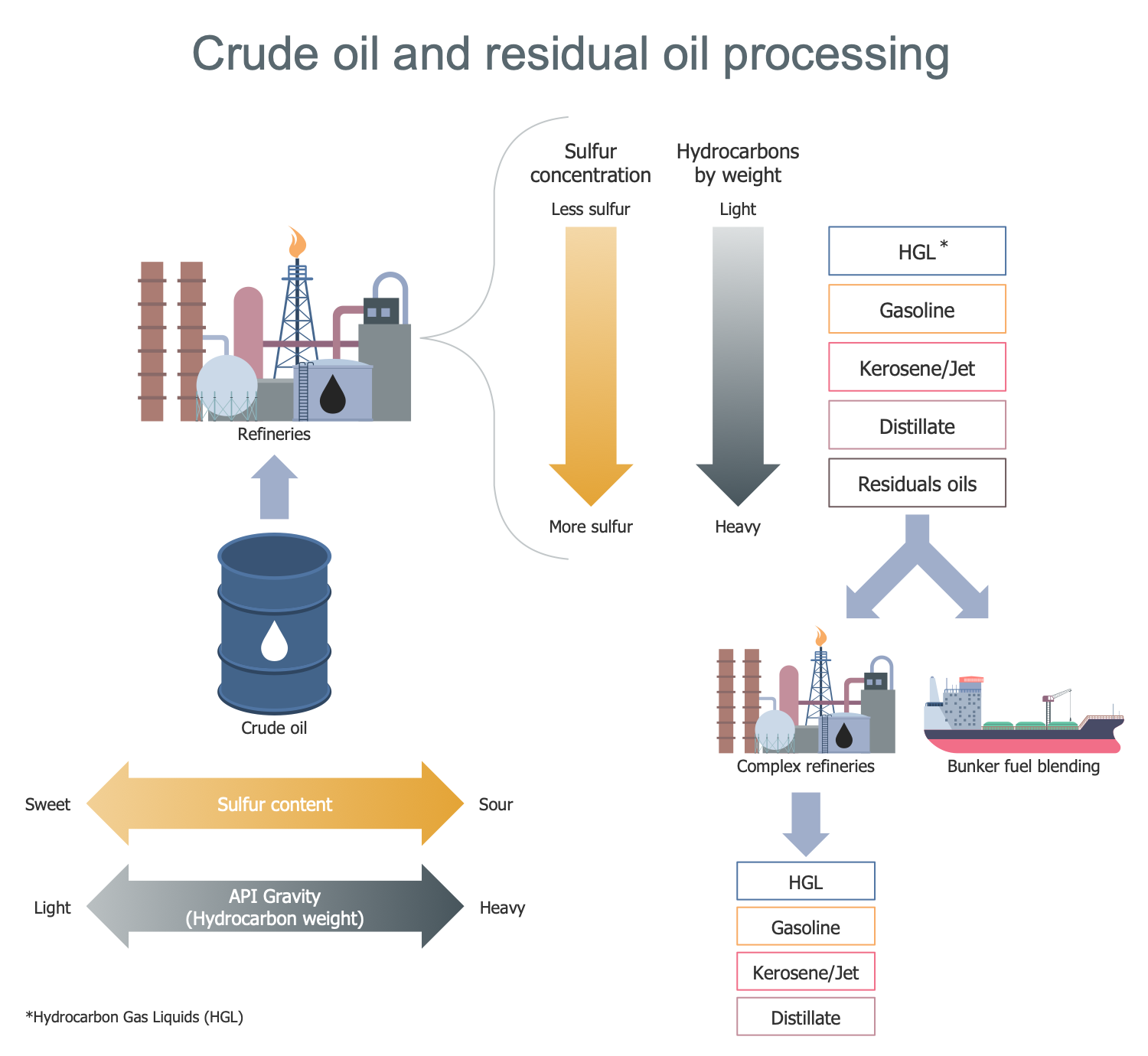

Forming: What Techniques Are Used in Oil Distribution?

In the context of oil distribution, “forming” typically refers to the processes involved in refining and preparing oil products for market. Key techniques include:

- Refining: Crude oil undergoes distillation to separate different hydrocarbon fractions. This includes processes such as cracking, reforming, and hydrotreating to produce gasoline, diesel, and other petrochemicals.

- Blending: Different oil products may be blended to meet specific requirements or standards. This ensures that the final product adheres to specifications for viscosity, density, and performance.

The use of advanced refining technologies enhances product quality and maximizes yield, which is crucial for B2B buyers who demand consistency and reliability.

Assembly: How Are Oil Products Packaged for Distribution?

In the assembly stage, refined oil products are prepared for delivery. This includes:

- Storage: Refined products are stored in tanks that meet safety and environmental standards. The design of these tanks is crucial to prevent leaks and contamination.

- Packaging: Depending on the end-use, oil products may be packaged in bulk containers, drums, or smaller packaging for retail distribution. Proper labeling is essential for compliance with international regulations.

Buyers should inquire about the supplier’s storage and packaging capabilities, as these can significantly impact product quality and safety during transport.

Finishing: What Final Touches Are Applied Before Distribution?

The finishing stage involves quality assurance measures that ensure the product meets all necessary specifications before distribution. This may include:

Illustrative image related to distribution of oil

- Final Quality Checks: Before leaving the facility, oil products undergo rigorous testing to verify that they meet industry standards. This includes checking for impurities, viscosity, and other critical parameters.

- Documentation and Compliance: Suppliers must prepare the necessary documentation to comply with international shipping and safety regulations. This includes safety data sheets (SDS) and certificates of analysis.

A thorough understanding of the finishing process helps buyers ensure that they receive high-quality products that comply with their operational requirements.

What Are the Key Quality Assurance Practices in Oil Distribution?

Quality assurance (QA) is critical in the oil distribution sector, where safety and compliance with international standards are paramount. Here, we outline the key practices and standards that B2B buyers should be aware of.

Which International Standards Are Relevant for Oil Distribution Quality Assurance?

Several international standards guide the quality assurance processes in oil distribution, including:

- ISO 9001: This standard outlines the criteria for a quality management system (QMS). It emphasizes customer satisfaction and continuous improvement, making it crucial for suppliers aiming to enhance their service quality.

- API Standards: The American Petroleum Institute (API) sets standards for the oil and natural gas industry, including product specifications, testing methods, and equipment standards.

B2B buyers should prioritize suppliers that are ISO 9001 certified and adhere to API standards to ensure product reliability and safety.

What Are the Key Quality Control Checkpoints in Oil Distribution?

Quality control (QC) checkpoints are integral to the manufacturing process, ensuring that products meet established specifications. Key checkpoints include:

- Incoming Quality Control (IQC): This involves inspecting raw materials upon arrival at the facility to ensure they meet required standards before processing begins.

- In-Process Quality Control (IPQC): Continuous monitoring during the manufacturing process helps identify and rectify any deviations from quality standards.

- Final Quality Control (FQC): At the end of the manufacturing process, products undergo final inspections and testing to confirm compliance with specifications before distribution.

These checkpoints are essential for maintaining high quality throughout the supply chain, and B2B buyers should seek suppliers with robust QC processes.

What Testing Methods Are Commonly Used in Oil Quality Assurance?

Common testing methods employed in quality assurance include:

- Chemical Analysis: Techniques such as gas chromatography and mass spectrometry assess the chemical composition of oil products, ensuring they meet required specifications.

- Physical Testing: Tests for viscosity, density, and pour point are conducted to verify product performance under various conditions.

Understanding these testing methods allows B2B buyers to evaluate the effectiveness of a supplier’s quality assurance processes.

How Can B2B Buyers Verify Supplier Quality Control Practices?

B2B buyers must ensure that their suppliers adhere to rigorous quality control practices. Here are some effective strategies for verifying supplier QC:

What Are the Best Practices for Conducting Supplier Audits?

Conducting regular audits of suppliers is a vital step in verifying their quality control practices. Key aspects include:

- Site Visits: Visiting the supplier’s facility can provide firsthand insight into their manufacturing processes and quality assurance measures.

- Documentation Review: Assessing quality manuals, inspection reports, and compliance certifications can help buyers evaluate the effectiveness of a supplier’s QC systems.

Regular audits not only verify compliance but also foster stronger relationships between buyers and suppliers.

How Can Third-Party Inspections Enhance Quality Assurance?

Engaging third-party inspectors can provide an unbiased assessment of a supplier’s quality practices. These inspections typically include:

- Quality Assessments: Third-party inspectors evaluate compliance with industry standards and the supplier’s internal quality processes.

- Testing Services: Independent testing of products can verify that they meet required specifications and safety standards.

Utilizing third-party inspections adds an extra layer of assurance for B2B buyers, particularly in regions where regulatory compliance is critical.

Illustrative image related to distribution of oil

What Nuances Should International Buyers Consider Regarding Quality Certification?

International buyers should be aware of specific nuances regarding quality certification:

- Regional Compliance: Different regions may have varying standards and regulations. Buyers should ensure that their suppliers meet local requirements, particularly in Africa, South America, the Middle East, and Europe.

- Certification Recognition: Not all certifications are recognized universally. Buyers should verify that the certifications held by suppliers are acknowledged in their respective markets.

Understanding these nuances helps international buyers navigate the complexities of quality assurance in oil distribution, ensuring they partner with reliable suppliers.

In conclusion, B2B buyers in the oil distribution sector must be diligent in assessing the manufacturing processes and quality assurance practices of their suppliers. By focusing on the outlined stages and quality control measures, buyers can ensure they select partners that meet their operational needs and uphold industry standards.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘distribution of oil’

Introduction

This guide serves as a practical checklist for international B2B buyers looking to procure oil distribution services. As the oil market is complex and varies significantly across regions such as Africa, South America, the Middle East, and Europe, following a structured approach will help ensure that buyers make informed decisions. This checklist highlights critical steps to facilitate a successful procurement process.

Step 1: Understand Your Market Needs

Before sourcing oil distribution, clearly define your market requirements. Consider the specific types of oil you need, the volumes, and the delivery timelines. Understanding these parameters will help you identify suitable suppliers and negotiate effectively.

- Regional Considerations: Different regions may have varying regulations and logistics challenges that could affect your procurement strategy.

- Market Demand: Research current market trends to gauge demand fluctuations and pricing, which can impact your sourcing decisions.

Step 2: Define Your Technical Specifications

Establishing precise technical specifications is crucial for ensuring that the oil meets your operational standards. This includes quality parameters, viscosity, and any necessary certifications.

Illustrative image related to distribution of oil

- Quality Standards: Specify the grade of oil required, as different industries may have unique quality demands.

- Compliance: Ensure that the oil complies with international standards and local regulations relevant to your industry.

Step 3: Evaluate Potential Suppliers

Conduct a thorough evaluation of potential suppliers to ensure they meet your criteria. Request detailed company profiles, including their experience, capabilities, and past performance in similar markets.

- References and Case Studies: Ask for references and case studies from other clients, particularly in your target region, to assess reliability and service quality.

- Financial Stability: Assess the financial health of suppliers to ensure they can sustain operations and fulfill long-term contracts.

Step 4: Verify Supplier Certifications

It is essential to confirm that suppliers hold the necessary certifications and licenses to operate in the oil distribution sector. This step ensures compliance with regulatory standards and enhances trust in the supplier.

- ISO Certifications: Look for ISO certifications related to quality management and environmental responsibility.

- Local Licenses: Ensure that the supplier is licensed to operate in the specific countries or regions you are targeting.

Step 5: Assess Logistics and Delivery Capabilities

Evaluate the logistics capabilities of potential suppliers, including their distribution networks, storage facilities, and transportation methods. Effective logistics are vital for timely and efficient delivery.

- Transportation Options: Consider the modes of transportation available (e.g., pipeline, tanker trucks) and their suitability for your delivery needs.

- Supply Chain Efficiency: Investigate how suppliers manage their supply chains to mitigate delays and ensure product availability.

Step 6: Negotiate Terms and Conditions

Once you have identified a suitable supplier, engage in negotiations to finalize terms and conditions. This includes pricing, payment terms, delivery schedules, and penalties for non-compliance.

- Long-term Contracts: Consider negotiating long-term agreements that can offer stability in pricing and supply.

- Flexibility Clauses: Include flexibility clauses to accommodate market changes or unexpected supply chain disruptions.

Step 7: Establish a Performance Monitoring System

After procurement, implement a system to monitor supplier performance. This ensures that suppliers meet the agreed-upon standards and can address any issues promptly.

Illustrative image related to distribution of oil

- Key Performance Indicators (KPIs): Define KPIs related to delivery times, product quality, and customer service.

- Regular Reviews: Schedule regular performance reviews to assess supplier compliance and identify areas for improvement.

By following this structured checklist, B2B buyers can navigate the complexities of oil distribution procurement, ensuring they make informed, strategic decisions that align with their business needs.

Comprehensive Cost and Pricing Analysis for distribution of oil Sourcing

What Are the Key Cost Components in Oil Distribution?

When analyzing the cost structure for the distribution of oil, several critical components come into play. These include materials, labor, manufacturing overhead, tooling, quality control (QC), logistics, and profit margin.

-

Materials: The primary cost driver is the oil itself, which varies significantly based on the type (e.g., crude, refined) and market conditions. Additionally, costs associated with storage tanks, pipelines, and other infrastructure must be considered.

-

Labor: Labor costs encompass the workforce involved in extraction, refining, and distribution. This includes wages, training, and benefits for skilled personnel who handle the logistics and quality assurance.

-

Manufacturing Overhead: This includes the indirect costs associated with production facilities and equipment maintenance. It also involves utilities and administrative expenses.

-

Tooling: Specialized equipment for drilling, refining, and transporting oil adds to the cost. Investment in advanced technology can lead to efficiency gains but requires substantial upfront capital.

-

Quality Control (QC): Ensuring that the oil meets various international standards and certifications incurs additional costs. This is particularly important for international buyers who may require specific quality certifications.

-

Logistics: Transportation costs, including shipping and handling, play a significant role in the overall cost structure. Factors like distance, mode of transport (pipeline, tanker, truck), and regulatory compliance affect logistics expenses.

-

Margin: Suppliers typically add a profit margin to cover risks and ensure profitability. This margin can fluctuate based on market conditions and competitive pressures.

How Do Price Influencers Affect Oil Distribution Costs?

Several factors influence the pricing of oil distribution, impacting the final cost to buyers:

-

Volume/MOQ: Bulk purchasing often leads to lower per-unit costs. Buyers should consider negotiating minimum order quantities (MOQ) to optimize pricing.

-

Specifications/Customization: Customized oil blends or specifications can lead to higher costs. Buyers need to balance their requirements with the potential price implications.

-

Materials: The quality of the oil and the materials used in transportation and storage can significantly impact pricing. Higher quality often comes at a premium.

-

Quality/Certifications: International certifications can enhance product value but may increase costs. Buyers should evaluate the necessity of these certifications against their budget.

-

Supplier Factors: Supplier reliability, reputation, and location can influence pricing. Established suppliers may charge more due to their reputation for quality and reliability.

-

Incoterms: The chosen Incoterms dictate the responsibilities and costs associated with shipping and delivery. Understanding these terms is vital for accurate cost assessment.

What Tips Can Buyers Use for Cost-Efficiency in Oil Distribution?

International buyers, particularly from Africa, South America, the Middle East, and Europe, should consider the following strategies to enhance cost-efficiency:

-

Negotiation: Engage in price negotiations with suppliers, focusing on volume discounts and long-term contracts to secure better rates.

-

Total Cost of Ownership (TCO): Evaluate the TCO rather than just the initial purchase price. Consider all associated costs, including logistics, storage, and potential penalties for non-compliance with specifications.

-

Understanding Pricing Nuances: Be aware of regional pricing differences and market conditions that can affect costs. For example, geopolitical factors in the Middle East can lead to price volatility.

-

Supplier Diversification: Avoid dependency on a single supplier by diversifying your sourcing strategy. This can enhance bargaining power and reduce risks associated with supply disruptions.

-

Regular Market Analysis: Stay informed about market trends, oil prices, and geopolitical developments. This knowledge can aid in making timely purchasing decisions that align with favorable pricing.

Disclaimer on Indicative Prices

Prices for oil distribution are subject to fluctuations based on market conditions, geopolitical factors, and supplier negotiations. It is advisable for buyers to conduct thorough market research and supplier assessments to obtain accurate pricing tailored to their specific needs.

Alternatives Analysis: Comparing distribution of oil With Other Solutions

Exploring Alternatives to Oil Distribution in the Energy Sector

In the evolving landscape of energy solutions, businesses are increasingly examining alternatives to traditional oil distribution. This exploration is driven by factors such as sustainability, cost efficiency, and technological advancements. As B2B buyers, especially from regions like Africa, South America, the Middle East, and Europe, understanding these alternatives can lead to more informed decisions regarding energy procurement and infrastructure investment.

Comparison Table of Distribution Solutions

| Comparison Aspect | Distribution Of Oil | Renewable Energy (Solar) | Natural Gas Distribution |

|---|---|---|---|

| Performance | High energy density, reliable | Variable output, dependent on sunlight | High efficiency, cleaner than oil |

| Cost | High initial infrastructure costs, fluctuating prices | Decreasing costs, often subsidized | Moderate costs, price stability |

| Ease of Implementation | Complex logistics, established infrastructure | Requires new installations, scalability issues | Existing infrastructure can be adapted |

| Maintenance | Requires regular upkeep, environmental considerations | Low maintenance once installed | Regular inspections needed, less intensive than oil |

| Best Use Case | Heavy industries, transportation | Residential, commercial energy needs | Power generation, heating, industrial applications |

In-Depth Analysis of Alternative Solutions

Renewable Energy (Solar)

Solar energy presents a promising alternative to oil distribution, particularly for businesses seeking sustainable solutions. The technology has seen significant advancements, resulting in decreasing costs and increasing efficiency. However, solar power’s performance is variable, heavily reliant on geographical factors and weather conditions. While the maintenance of solar panels is relatively low, the initial setup can be expensive and complex, especially in regions lacking existing infrastructure. Solar energy is best suited for residential and commercial applications where energy independence and sustainability are priorities.

Natural Gas Distribution

Natural gas serves as a viable alternative to oil, offering a cleaner-burning solution with lower carbon emissions. It is often considered a bridge fuel in the transition towards more renewable energy sources. The distribution of natural gas benefits from existing infrastructure in many regions, making it easier to implement compared to entirely new systems. However, it still requires regular inspections and maintenance to ensure safety and efficiency. Natural gas is particularly effective for power generation, heating, and industrial applications, providing a reliable energy source that can complement renewables.

Making the Right Choice for Energy Solutions

As international B2B buyers assess their energy distribution options, it is crucial to weigh the benefits and drawbacks of each alternative in relation to their specific operational needs. Factors such as performance reliability, cost implications, and ease of implementation should guide decision-making. Businesses aiming for sustainability might prioritize solar energy, while those needing immediate energy solutions may find natural gas more suitable. Ultimately, the right choice will depend on a company’s energy requirements, financial considerations, and commitment to environmental responsibility.

Essential Technical Properties and Trade Terminology for distribution of oil

What Are the Key Technical Properties for Oil Distribution?

Understanding the essential technical properties of oil is crucial for B2B buyers involved in its distribution. Here are some critical specifications:

Illustrative image related to distribution of oil

-

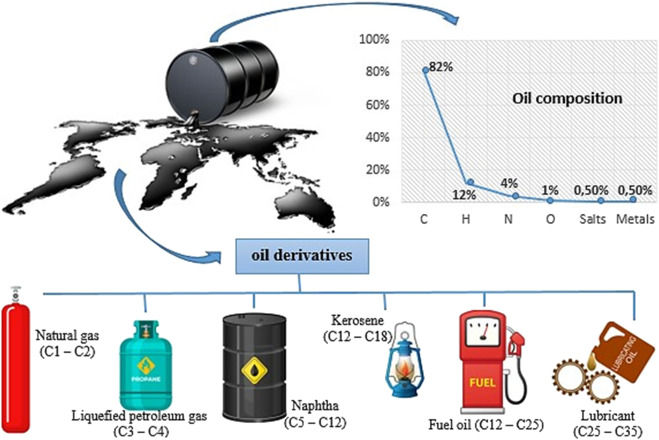

API Gravity

API Gravity measures the density of crude oil in comparison to water. A higher API gravity indicates lighter crude, which is generally more desirable due to its easier refining process and higher market value. For buyers, understanding API gravity helps in assessing the quality and potential yield of crude oil, impacting purchasing decisions and refining strategies. -

Sulfur Content

The sulfur content in crude oil is significant as it affects both the refining process and the environmental regulations applicable to fuel products. Low-sulfur crude is often preferred due to its lower emissions and compliance with environmental standards. Buyers must consider sulfur content to avoid penalties and ensure the oil meets their operational and regulatory requirements. -

Viscosity

Viscosity refers to the thickness of the oil and its resistance to flow. This property is critical for transportation and processing. High-viscosity oils may require heating or special pumping equipment to facilitate movement. Buyers need to evaluate viscosity to ensure that the oil can be efficiently transported and processed within their existing infrastructure. -

Pour Point

The pour point is the lowest temperature at which oil can flow. This property is particularly important in colder climates where oil may solidify, affecting transportation and storage. Buyers must assess the pour point to determine suitable storage solutions and transportation methods, ensuring that the oil remains in a liquid state throughout the supply chain. -

Flash Point

The flash point is the lowest temperature at which vapors from the oil can ignite. It is a critical safety parameter for storage and transportation. Buyers must be aware of the flash point to implement appropriate safety measures and comply with regulatory requirements, minimizing the risk of accidents during handling.

What Are Common Trade Terms in Oil Distribution?

Familiarity with industry jargon is essential for effective communication and negotiation in the oil distribution market. Here are some key terms:

-

OEM (Original Equipment Manufacturer)

An OEM refers to a company that produces parts or equipment that may be marketed by another manufacturer. In the oil industry, this could relate to equipment used in drilling or refining processes. Buyers should understand OEM relationships to ensure they are sourcing quality equipment that meets their operational needs. -

MOQ (Minimum Order Quantity)

MOQ indicates the smallest quantity of a product that a supplier is willing to sell. This term is essential for buyers to understand, as it impacts inventory management and cash flow. Knowing the MOQ helps buyers plan their purchases more effectively and negotiate better terms. -

RFQ (Request for Quotation)

An RFQ is a document used to invite suppliers to bid on specific products or services. It outlines the buyer’s requirements and solicits pricing information. Utilizing RFQs can streamline the procurement process, allowing buyers to compare prices and terms from multiple suppliers efficiently. -

Incoterms (International Commercial Terms)

Incoterms are a set of predefined international trade terms that clarify the responsibilities of buyers and sellers in shipping goods. For oil distribution, understanding Incoterms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) is vital for determining liability and cost allocation during transport. -

Brent and WTI

Brent and WTI (West Texas Intermediate) are two major benchmarks for oil pricing. They represent different grades of crude oil and can influence pricing strategies. Buyers should monitor these benchmarks to make informed purchasing decisions and gauge market trends.

By grasping these technical properties and trade terminologies, B2B buyers can enhance their decision-making processes, ensure compliance with industry standards, and establish more effective supplier relationships in the global oil distribution market.

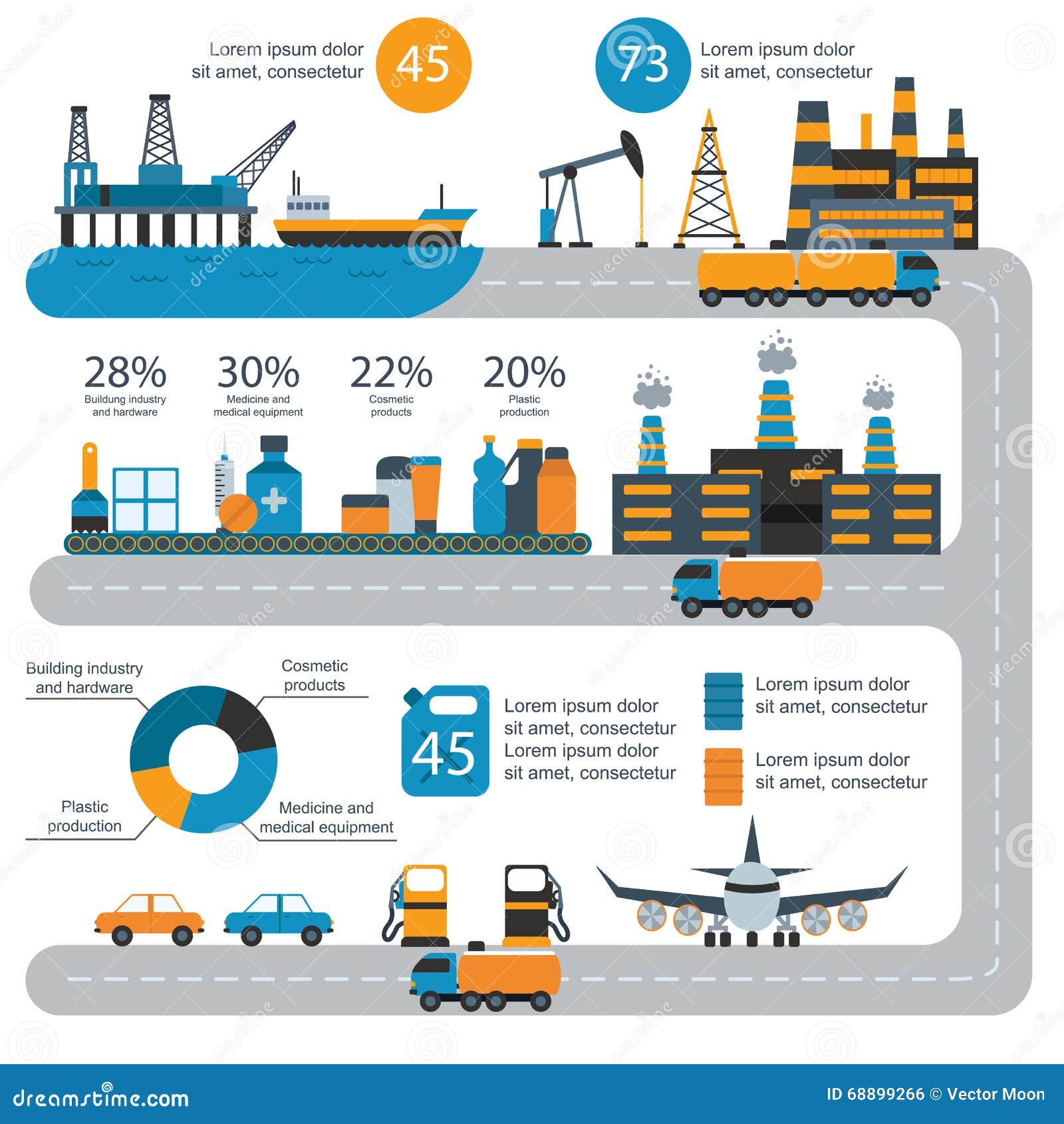

Navigating Market Dynamics and Sourcing Trends in the distribution of oil Sector

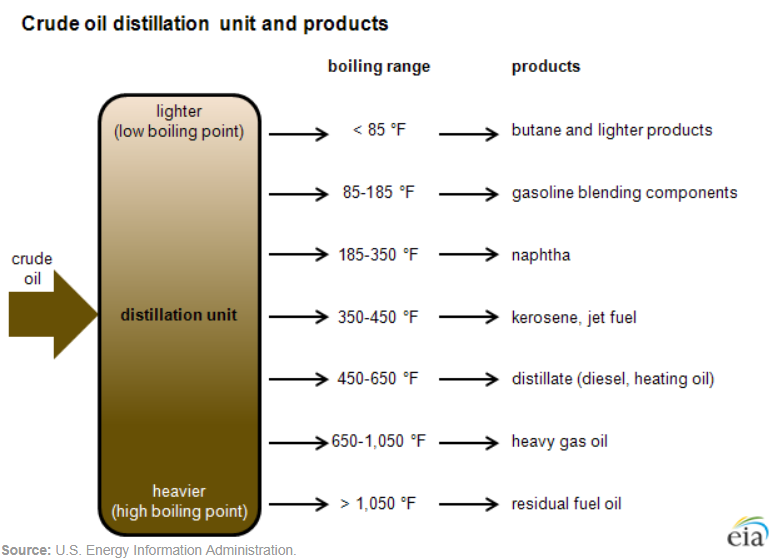

What Are the Current Market Dynamics and Key Trends in the Oil Distribution Sector?

The global oil distribution sector is undergoing significant transformation driven by geopolitical shifts, technological advancements, and evolving consumer preferences. Key markets such as the Middle East, Africa, and South America are seeing increased investment in infrastructure to enhance distribution networks, particularly in regions like Saudi Arabia and Brazil. The rise of digital technologies, including blockchain and IoT, is reshaping supply chain management, offering enhanced transparency and efficiency. Blockchain technology, for instance, is being utilized to track shipments and verify the provenance of oil, which is especially critical for B2B buyers concerned about the integrity of their supply chains.

Illustrative image related to distribution of oil

Additionally, the ongoing transition to renewable energy is influencing oil distribution strategies. Companies are diversifying their portfolios to include alternative energy sources, which is particularly relevant for buyers in Europe, where regulatory pressures for greener energy solutions are strong. This diversification can create new opportunities for international B2B buyers to engage with suppliers who are not only focused on oil but also exploring sustainable energy solutions. Furthermore, fluctuating oil prices, influenced by OPEC decisions and geopolitical tensions, necessitate that buyers stay agile, adapting their sourcing strategies to mitigate risks associated with price volatility.

How Does Sustainability and Ethical Sourcing Impact the Oil Distribution Sector?

Sustainability and ethical sourcing are becoming paramount considerations in the oil distribution sector. The environmental impact of oil extraction and distribution is under intense scrutiny, prompting many companies to adopt more sustainable practices. Buyers are increasingly prioritizing suppliers who demonstrate a commitment to reducing carbon emissions and minimizing ecological footprints. This trend is particularly evident in Europe, where stringent regulations are in place to promote greener practices within supply chains.

Ethical supply chains are essential for maintaining brand reputation and consumer trust. Buyers should seek partners that can provide certifications indicating adherence to environmental standards and ethical labor practices. Certifications such as ISO 14001 for environmental management and various green certifications for sustainable practices are becoming critical in supplier selection. Additionally, the push for transparency in sourcing means that buyers must engage with suppliers who can provide detailed information about their environmental practices and the sourcing of their materials. This commitment to sustainability not only benefits the planet but also enhances business resilience in an evolving market landscape.

How Has the Oil Distribution Sector Evolved Over Time?

The oil distribution sector has experienced remarkable evolution since the first commercial oil well was drilled in the mid-19th century. Initially characterized by small-scale operations and local markets, the industry has grown into a complex global network driven by technological advancements and increasing demand for energy. The establishment of major oil companies and the discovery of vast reserves in regions like the Middle East have transformed oil into a critical component of the global economy.

In recent decades, the rise of geopolitical tensions and environmental awareness has further shaped the industry. The emergence of OPEC in the 1960s established a framework for regulating oil production and prices, significantly impacting global trade dynamics. Today, the sector is navigating challenges posed by climate change, with a noticeable shift towards sustainable practices and alternative energy sources. As the industry continues to adapt, international B2B buyers must remain informed and agile to leverage emerging trends and ensure their sourcing strategies align with the future landscape of oil distribution.

Frequently Asked Questions (FAQs) for B2B Buyers of distribution of oil

-

How do I ensure compliance with international regulations when sourcing oil?

To ensure compliance with international regulations, familiarize yourself with both the exporting and importing countries’ laws related to oil distribution. Key regulations may include environmental standards, safety protocols, and trade tariffs. Collaborate with experienced legal advisors or compliance consultants who specialize in oil and gas trade. Additionally, ensure that your suppliers provide all necessary documentation, such as certificates of origin and quality assurance, to facilitate smooth customs clearance and avoid potential legal issues. -

What factors should I consider when vetting oil suppliers?

When vetting oil suppliers, evaluate their financial stability, production capacity, and track record in fulfilling contracts. Request references from other clients and assess their compliance with international quality and safety standards. Investigate their logistical capabilities, including storage and transportation infrastructure, as these can significantly impact your supply chain. Lastly, consider their responsiveness to inquiries and willingness to customize offerings to meet your specific needs. -

What is the typical minimum order quantity (MOQ) for oil distribution?

The minimum order quantity (MOQ) for oil distribution can vary significantly based on the supplier, type of oil, and your location. Generally, MOQs range from a few hundred barrels to several thousand, depending on the supplier’s capacity and the logistics involved. It is advisable to discuss your specific requirements with potential suppliers to understand their MOQ policies and negotiate terms that align with your business needs. -

What payment terms are common in oil distribution contracts?

Common payment terms in oil distribution contracts include upfront payments, letters of credit, or staggered payments based on delivery milestones. The specific terms often depend on the buyer-supplier relationship, order size, and market conditions. It’s critical to clearly define payment terms in the contract to avoid disputes and ensure timely transactions. Additionally, consider using secure payment methods to protect your financial interests. -

How can I customize oil products to meet my specific needs?

To customize oil products, communicate your specific requirements to potential suppliers early in the negotiation process. Discuss factors such as viscosity, purity, and additives necessary for your application. Many suppliers offer tailored solutions based on client needs, but this often requires a minimum order quantity. Ensure that customization details are documented in your contract to avoid misunderstandings and ensure the final product meets your specifications. -

What quality assurance measures should I expect from oil suppliers?

Quality assurance measures from oil suppliers should include regular testing of oil samples for purity, viscosity, and compliance with international standards. Suppliers should provide documentation such as certificates of analysis that verify the quality of the oil. Additionally, inquire about their quality control processes, including how they handle any deviations from quality standards. Establishing clear quality expectations in your contract will help ensure that you receive products that meet your requirements. -

What logistical considerations should I keep in mind for oil distribution?

Logistical considerations for oil distribution include transportation methods, storage facilities, and lead times for delivery. Determine the most efficient transportation routes and methods based on your location and supplier capabilities. Ensure that storage facilities comply with safety regulations and have adequate capacity for your needs. Additionally, discuss lead times with your supplier to plan accordingly and maintain a steady supply chain. -

How do geopolitical factors influence oil sourcing and distribution?

Geopolitical factors can significantly impact oil sourcing and distribution by affecting supply stability, pricing, and trade agreements. Monitor regional conflicts, sanctions, and diplomatic relations that may influence oil production and transportation. Diversifying your supplier base across different regions can mitigate risks associated with geopolitical instability. Stay informed about global market trends and geopolitical developments to make strategic sourcing decisions that align with your business objectives.

Top 3 Distribution Of Oil Manufacturers & Suppliers List

1. Britannica – Global Petroleum Distribution

Domain: britannica.com

Registered: 1995 (30 years)

Introduction: Petroleum is not evenly distributed globally, with slightly less than half of the world’s proven reserves located in the Middle East. Key regions include Canada, the United States, Latin America, Africa, and the former Soviet Union. The Middle East holds about 50% of proven reserves but only accounts for 30% of global oil production, while the U.S. has less than 2% of reserves but produces roughly…

2. PMFIAS – Global Oilfield Insights

Domain: pmfias.com

Registered: 2015 (10 years)

Introduction: World distribution of Petroleum and Mineral Oil includes supergiant oilfields located in various regions: 1. **Saudi Arabia**: Second largest proven oil reserves (20% of world reserves), notable fields include Al-Ghawār (70 billion barrels left) and Saffaniyah (largest offshore field). 2. **Iraq, Kuwait, & Iran**: Each has about 25% of global proven reserves, with Al-Burqan in Kuwait being the sec…

3. EBSCO – Oil and Gas Distribution Insights

Domain: ebsco.com

Registered: 1990 (35 years)

Introduction: Oil and gas distribution is a critical component of the petroleum industry, focusing on the extraction, processing, and transportation of nonrenewable resources. Key details include:

– Crude oil production is primarily in Russia, Saudi Arabia, the United States, and Venezuela; natural gas production is concentrated in the U.S., Canada, and Iran.

– Petroleum forms through geological processes inv…

Strategic Sourcing Conclusion and Outlook for distribution of oil

As the global oil market continues to evolve, strategic sourcing has become essential for B2B buyers aiming to optimize their supply chains. Key insights reveal that while the Middle East remains a pivotal player in oil reserves, emerging markets in Africa and South America are increasingly significant, presenting new opportunities for sourcing partnerships. Understanding the geographical distribution of oil resources can aid buyers in making informed decisions, enabling them to capitalize on favorable pricing and availability.

Strategic sourcing not only enhances cost efficiency but also fosters relationships with reliable suppliers, ensuring a steady flow of high-quality products. By prioritizing transparency and sustainability in sourcing practices, businesses can navigate the complexities of the oil market more effectively, aligning with global trends toward responsible consumption.

Looking ahead, international buyers from regions such as Saudi Arabia, Brazil, and beyond should actively seek partnerships that leverage both established and emerging oil markets. Embrace innovation in sourcing strategies to remain competitive and agile in this dynamic industry. Now is the time to invest in robust supply chains that will drive growth and resilience in your operations. Engage with trusted suppliers and explore new markets to unlock the full potential of your oil distribution strategy.

Illustrative image related to distribution of oil

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.