Introduction: Navigating the Global Market for oil and gas field development

In the complex landscape of oil and gas field development, B2B buyers face the critical challenge of sourcing reliable suppliers who can deliver innovative solutions tailored to their specific needs. As the demand for energy continues to surge, navigating the intricacies of oil field development—from exploration and appraisal to decommissioning—requires a comprehensive understanding of the various phases involved. This guide serves as an essential resource for international buyers, particularly those in Africa, South America, the Middle East, and Europe, including key markets like Germany and Nigeria.

Throughout this guide, we will delve into the multifaceted aspects of oil and gas field development, covering essential topics such as types of oil fields, applications, supplier vetting processes, and cost considerations. By equipping you with actionable insights and best practices, we aim to empower you to make informed purchasing decisions that align with your strategic objectives.

Whether you are looking to optimize production, manage risk, or ensure compliance with environmental regulations, our guide offers valuable perspectives that will enhance your understanding of the global market. Together, we can navigate the complexities of oil and gas field development and drive sustainable growth in this vital industry.

Indice dei contenuti

- Top 4 Oil And Gas Field Development Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for oil and gas field development

- Understanding oil and gas field development Types and Variations

- Key Industrial Applications of oil and gas field development

- 3 Common User Pain Points for ‘oil and gas field development’ & Their Solutions

- Strategic Material Selection Guide for oil and gas field development

- In-depth Look: Manufacturing Processes and Quality Assurance for oil and gas field development

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘oil and gas field development’

- Comprehensive Cost and Pricing Analysis for oil and gas field development Sourcing

- Alternatives Analysis: Comparing oil and gas field development With Other Solutions

- Essential Technical Properties and Trade Terminology for oil and gas field development

- Navigating Market Dynamics and Sourcing Trends in the oil and gas field development Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of oil and gas field development

- Strategic Sourcing Conclusion and Outlook for oil and gas field development

- Disclaimer importante e condizioni d'uso

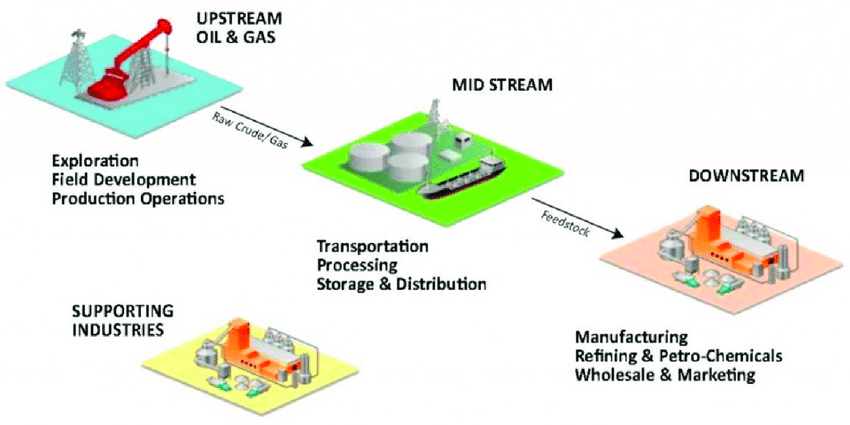

Understanding oil and gas field development Types and Variations

| Nome del tipo | Caratteristiche distintive principali | Applicazioni primarie B2B | Brevi pro e contro per gli acquirenti |

|---|---|---|---|

| Conventional Oil Field | Traditional extraction methods; relies on natural pressure | Large-scale extraction, refineries | Pro: Established technology, predictable yields. Contro: Higher environmental impact, limited to specific locations. |

| Unconventional Oil Field | Involves techniques like fracking; targets tight formations | Shale gas extraction, heavy oil recovery | Pro: Access to previously untapped reserves. Contro: Higher costs, environmental concerns. |

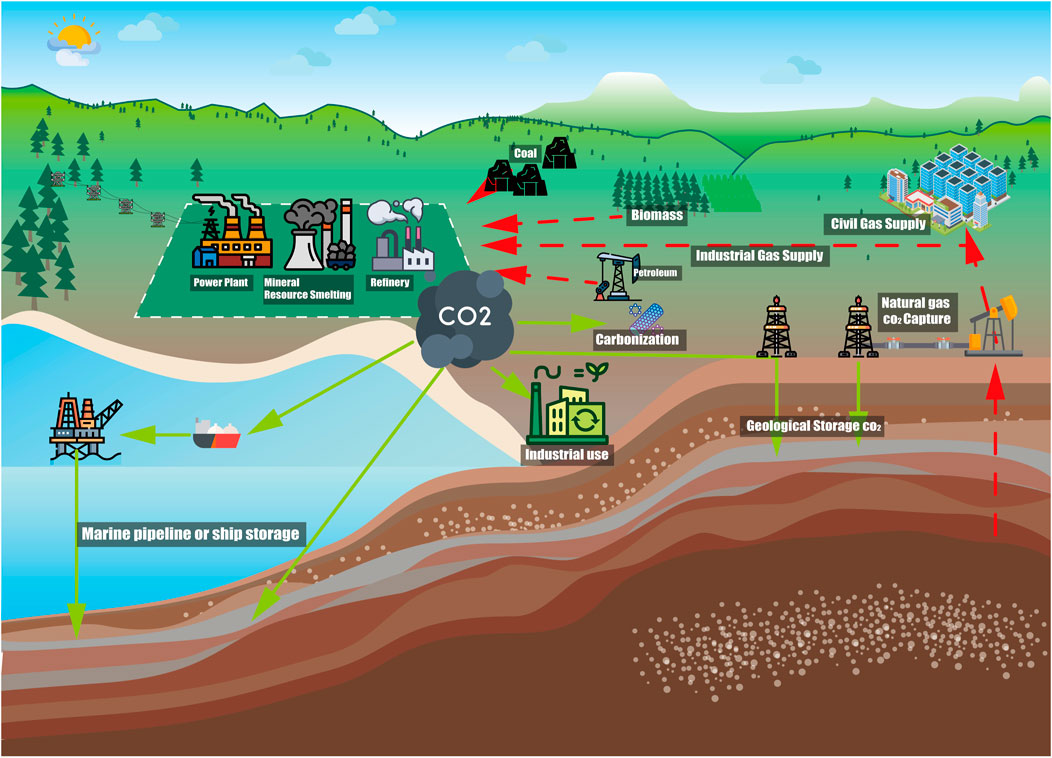

| Enhanced Oil Recovery (EOR) | Utilizes advanced techniques (e.g., CO2 injection) to increase yield | Mature fields, maximizing existing assets | Pro: Boosts production from existing wells. Contro: Significant upfront investment, technical complexity. |

| Offshore Oil Development | Involves drilling in oceanic environments; complex logistics | Deepwater drilling, subsea installations | Pro: Access to vast resources; potential for high yield. Contro: High costs, regulatory challenges, environmental risks. |

| Oil Sands Development | Extraction from tar sands using surface mining or in-situ methods | Heavy crude production, refining | Pro: Large reserves; stable supply. Contro: High carbon footprint, extensive water use. |

What Are the Characteristics of Conventional Oil Fields?

Conventional oil fields are characterized by their reliance on natural geological formations that allow oil to flow freely to the surface. These fields typically use traditional drilling methods and are often found in regions with established infrastructure. Buyers interested in conventional oil development should consider factors such as location, the existing regulatory framework, and the availability of skilled labor. The predictability of yields makes these fields attractive, yet potential environmental impacts and declining reserves necessitate a comprehensive understanding of sustainability practices.

How Do Unconventional Oil Fields Differ?

Unconventional oil fields employ advanced extraction techniques, such as hydraulic fracturing and horizontal drilling, to access oil trapped in tight rock formations or shale. This type of development has opened up previously inaccessible reserves, making it a key player in modern energy markets. B2B buyers should evaluate the initial costs associated with technology and infrastructure, as well as the long-term sustainability of such operations. While unconventional fields can yield significant returns, they also come with heightened environmental scrutiny and regulatory hurdles.

What Is Enhanced Oil Recovery (EOR)?

Enhanced Oil Recovery (EOR) is a technique used to increase the amount of crude oil that can be extracted from an oil field after primary and secondary recovery methods have been exhausted. EOR techniques, such as CO2 injection, can significantly boost production levels in mature fields. For B2B buyers, understanding the technical requirements and costs associated with EOR is crucial. While EOR can extend the life of existing assets, it often requires substantial upfront investment and a deep understanding of reservoir engineering.

What Are the Challenges of Offshore Oil Development?

Offshore oil development involves drilling in marine environments, often at significant depths. This type of development presents unique logistical challenges, including the need for specialized equipment and adherence to strict environmental regulations. Buyers must consider the high capital investment and operational risks associated with offshore projects, as well as the potential for high yields. However, the complexity of offshore operations often leads to increased costs and potential delays, making thorough planning essential.

Why Invest in Oil Sands Development?

Oil sands development focuses on extracting heavy crude from tar sands through surface mining or in-situ methods. This type of development is particularly relevant for regions with large reserves, such as Canada. B2B buyers should weigh the benefits of stable supply against the environmental concerns associated with high carbon emissions and extensive water usage. While oil sands can provide a significant energy source, the sustainability of such projects is increasingly coming under scrutiny, necessitating a balance between economic viability and environmental responsibility.

Key Industrial Applications of oil and gas field development

| Industria/Settore | Specific Application of oil and gas field development | Valore/Beneficio per l'azienda | Considerazioni chiave sull'approvvigionamento per questa applicazione |

|---|---|---|---|

| Energy Production | Exploration and drilling of new oil wells | Increased production capacity and revenue streams | Expertise in geological surveys and drilling technology |

| Petrochemicals | Development of infrastructure for refining | Enhanced efficiency in processing raw materials | Quality assurance in equipment and compliance standards |

| Transportation and Logistics | Pipeline installation for oil and gas distribution | Reduced transportation costs and improved supply chain efficiency | Reliability of materials and adherence to safety regulations |

| Environmental Services | Decommissioning and site restoration | Compliance with environmental regulations and sustainability goals | Experience in environmental assessments and remediation techniques |

| Construction and Engineering | Construction of extraction facilities | Efficient project execution and adherence to timelines | Skilled labor availability and project management expertise |

How is Oil and Gas Field Development Applied in Energy Production?

In energy production, oil and gas field development focuses on the exploration and drilling of new wells. This application is crucial for increasing production capacity and generating additional revenue streams for energy companies. For international B2B buyers, especially in regions like Africa and the Middle East, it is essential to source expertise in geological surveys and drilling technology. Challenges include navigating regulatory frameworks and ensuring sustainable practices while optimizing extraction efforts.

What Role Does Oil and Gas Field Development Play in Petrochemicals?

In the petrochemical sector, oil and gas field development is vital for establishing the necessary infrastructure for refining crude oil into valuable products. By enhancing efficiency in processing raw materials, companies can maximize profitability and reduce operational costs. Buyers in this industry should prioritize sourcing high-quality equipment and ensuring compliance with safety and environmental standards to mitigate risks associated with refining processes.

How Does Oil and Gas Field Development Improve Transportation and Logistics?

The installation of pipelines for oil and gas distribution is a key application of oil and gas field development within transportation and logistics. This infrastructure not only reduces transportation costs but also improves supply chain efficiency. International buyers must consider the reliability of materials used in pipeline construction, as well as adherence to stringent safety regulations, to prevent leaks and ensure the safe transport of hydrocarbons.

Why is Decommissioning Important in Environmental Services?

Decommissioning and site restoration are critical components of oil and gas field development, particularly for environmental services. This application ensures compliance with environmental regulations and supports sustainability goals by properly handling and recycling equipment and materials. Buyers in this space should seek partners with experience in environmental assessments and remediation techniques to effectively manage the complexities of decommissioning projects.

How Does Construction and Engineering Benefit from Oil and Gas Field Development?

In the construction and engineering sector, oil and gas field development involves the construction of extraction facilities, which is essential for efficient project execution. This application helps ensure that projects adhere to timelines and budgets, ultimately increasing profitability. B2B buyers should focus on sourcing skilled labor and project management expertise to navigate the challenges of building complex infrastructure while maintaining high safety and quality standards.

3 Common User Pain Points for ‘oil and gas field development’ & Their Solutions

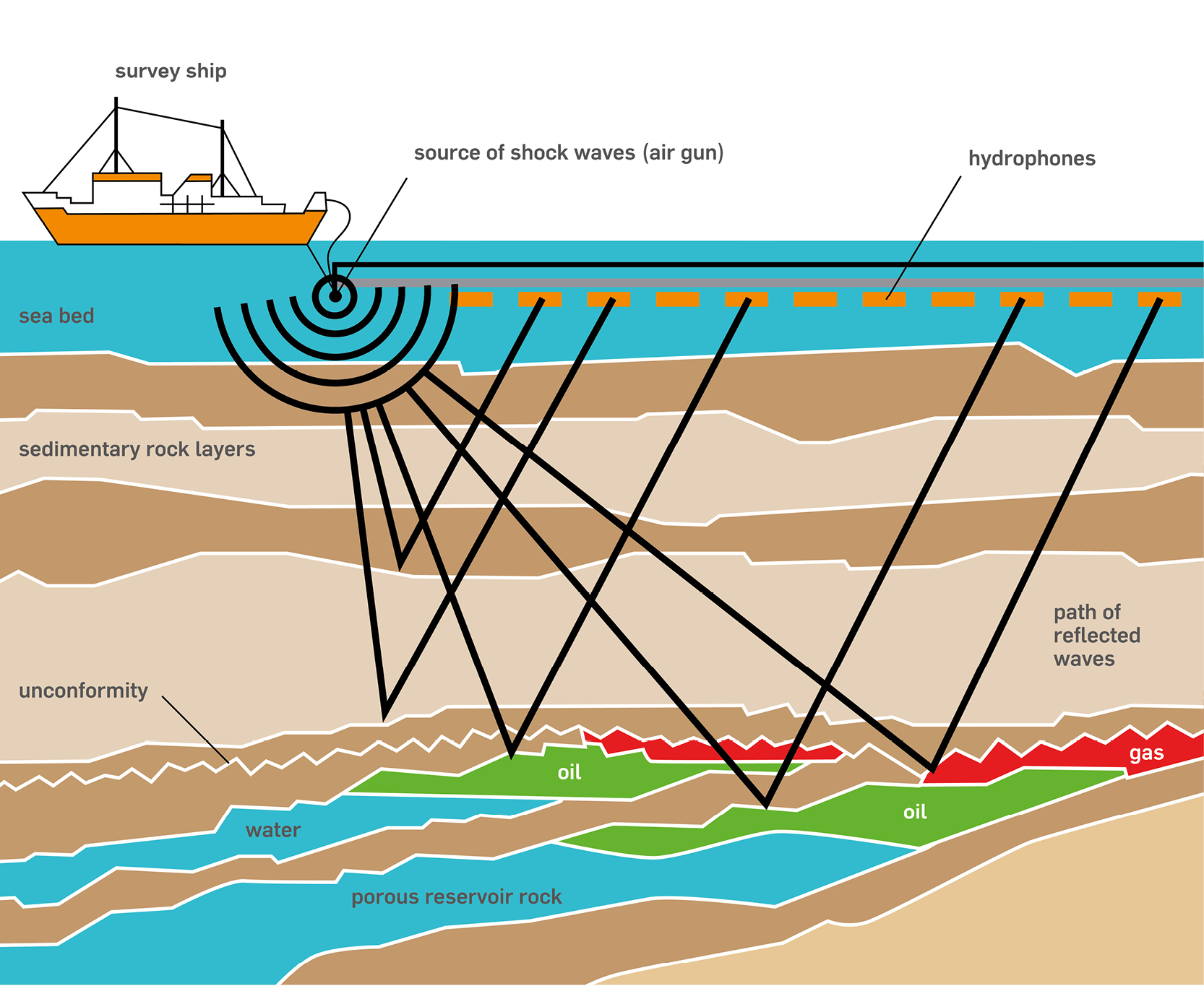

Scenario 1: Difficulty in Identifying Viable Oil Reserves

Il problema: One of the most significant challenges B2B buyers face in oil and gas field development is the difficulty in accurately identifying viable oil reserves. This issue is particularly pronounced in regions with complex geological structures, such as those found in parts of Africa and South America. Buyers often struggle with the initial exploration phase, where investment decisions hinge on geological analyses, seismic surveys, and exploratory drilling. Inaccurate assessments can lead to wasted resources, both in time and capital, as stakeholders may inadvertently invest in non-productive sites.

La soluzione: To mitigate this risk, buyers should adopt advanced geological and geophysical exploration techniques, leveraging modern technologies such as 3D seismic imaging and machine learning algorithms for data analysis. Engaging with specialized geoscience firms can provide access to expertise in geological modeling and reservoir characterization. Additionally, utilizing a phased approach to exploration—starting with comprehensive desktop studies followed by targeted seismic surveys—can help refine site selection before significant investments are made. By prioritizing partnerships with experienced consultants, buyers can ensure a more reliable assessment of reserve potential, ultimately leading to more informed decision-making.

Scenario 2: Managing Regulatory Compliance and Environmental Concerns

Il problema: Navigating the complex web of regulatory compliance and environmental concerns is another pain point for B2B buyers in oil and gas field development. In regions like the Middle East and Europe, stringent regulations related to environmental protection and sustainable practices are in place. Buyers face the daunting task of ensuring that their projects adhere to local laws, which can vary significantly across jurisdictions. Failing to comply can result in costly fines, project delays, and reputational damage.

La soluzione: To effectively manage compliance, buyers should invest in comprehensive environmental impact assessments (EIAs) early in the project lifecycle. Collaborating with environmental consultants who understand local regulations can provide valuable insights into compliance requirements. Additionally, establishing an internal compliance team focused on ongoing regulatory updates and engaging with local communities can enhance transparency and foster goodwill. Implementing a robust environmental management system (EMS) that tracks compliance measures and integrates sustainability practices can also help mitigate risks and demonstrate corporate responsibility.

Illustrative image related to oil and gas field development

Scenario 3: Supply Chain Disruptions and Cost Overruns

Il problema: Supply chain disruptions and cost overruns are prevalent issues in oil and gas field development, particularly when sourcing materials and services from diverse international markets. Buyers often encounter delays in procurement, which can lead to project timelines being extended and budgets being exceeded. This is especially true in remote areas where logistical challenges and limited supplier options can impact delivery schedules and quality standards.

La soluzione: To counteract these challenges, buyers should develop a strategic procurement plan that includes multiple suppliers to mitigate dependency on single sources. Implementing just-in-time inventory practices can help reduce holding costs while ensuring that essential materials are available when needed. Additionally, leveraging technology such as supply chain management software can enhance visibility and facilitate real-time tracking of materials. Building strong relationships with local suppliers can also yield advantages in terms of reliability and cost-effectiveness. By proactively managing the supply chain and establishing contingency plans, buyers can minimize disruptions and control costs more effectively.

Strategic Material Selection Guide for oil and gas field development

When selecting materials for oil and gas field development, several factors must be taken into account, including performance characteristics, cost-effectiveness, and compliance with international standards. Here, we analyze four commonly used materials in the industry: carbon steel, stainless steel, high-density polyethylene (HDPE), and fiberglass-reinforced plastic (FRP). Each material has unique properties and applications that can significantly impact project outcomes.

What Are the Key Properties of Carbon Steel in Oil and Gas Applications?

Carbon steel is widely used in the oil and gas industry due to its excellent mechanical properties and cost-effectiveness. Key properties include high tensile strength, good weldability, and the ability to withstand high pressures. However, its susceptibility to corrosion, especially in harsh environments, necessitates protective coatings or cathodic protection systems. For international buyers, compliance with standards such as ASTM A106 for seamless carbon steel pipes is crucial, particularly in regions with stringent regulatory frameworks like Europe and the Middle East.

What Advantages and Disadvantages Does Stainless Steel Offer?

Stainless steel is favored for its superior corrosion resistance, making it suitable for applications involving aggressive media such as sour gas and seawater. Its high-temperature and pressure ratings also make it ideal for critical components like valves and fittings. However, stainless steel is generally more expensive than carbon steel and can be more challenging to fabricate. Buyers in Africa and South America should consider local availability and potential supply chain issues, as well as compliance with standards such as ASTM A312 for stainless steel pipes.

How Does High-Density Polyethylene (HDPE) Perform in Oil and Gas Applications?

HDPE is increasingly used for pipelines and storage tanks due to its lightweight nature, flexibility, and excellent chemical resistance. It is particularly effective in transporting corrosive substances, reducing the risk of leaks and environmental contamination. However, HDPE’s lower temperature and pressure ratings compared to metals may limit its use in high-stress applications. For international buyers, adherence to standards like ASTM D3350 is essential, especially in regions with emerging markets where infrastructure is still developing.

What Role Does Fiberglass-Reinforced Plastic (FRP) Play in Oil and Gas Development?

FRP is recognized for its high strength-to-weight ratio, corrosion resistance, and thermal insulation properties. It is commonly used in piping systems and storage tanks, particularly in offshore applications where weight savings are critical. While FRP is durable and long-lasting, its higher initial cost and complex manufacturing processes can be drawbacks. Buyers in the Middle East and Europe should ensure compliance with standards such as ASTM D3299, as well as consider the availability of skilled labor for installation and maintenance.

Summary Table of Material Selection for Oil and Gas Field Development

| Materiale | Typical Use Case for oil and gas field development | Vantaggio chiave | Svantaggi/limitazioni principali | Costo relativo (basso/medio/alto) |

|---|---|---|---|---|

| Carbon Steel | Pipelines, structural components | Cost-effective and strong | Suscettibile alla corrosione | Medio |

| Acciaio inox | Valves, fittings, high-pressure applications | Excellent corrosion resistance | Higher cost and fabrication complexity | Alto |

| High-Density Polyethylene | Pipelines, storage tanks | Lightweight and chemically resistant | Lower temperature and pressure ratings | Medio |

| Fiberglass-Reinforced Plastic | Piping systems, storage tanks | High strength-to-weight ratio | Higher initial cost and complex manufacturing | Alto |

In conclusion, the selection of materials for oil and gas field development is critical and should be guided by a thorough understanding of each material’s properties, advantages, and limitations. International buyers must also consider regional standards and compliance requirements to ensure successful project execution.

In-depth Look: Manufacturing Processes and Quality Assurance for oil and gas field development

What Are the Main Stages of Manufacturing Processes in Oil and Gas Field Development?

The manufacturing processes involved in oil and gas field development are complex and multifaceted, comprising several stages that ensure the effective production and delivery of equipment and materials. These stages typically include material preparation, forming, assembly, and finishing.

How Is Material Prepared for Oil and Gas Field Development?

Material preparation is the foundational step that involves selecting and processing raw materials suitable for the harsh conditions of oil and gas environments. Key materials often include steel, alloys, and composite materials, which are chosen for their strength and resistance to corrosion.

During this stage, materials undergo several processes such as cutting, machining, and treatment to enhance their properties. For instance, steel may be treated with anti-corrosive coatings to withstand the corrosive nature of oil and gas. Additionally, quality checks are performed to ensure that materials meet specified standards, including chemical composition and physical properties.

What Forming Techniques Are Commonly Used in Oil and Gas Manufacturing?

Forming is the next critical stage in the manufacturing process, where raw materials are shaped into components necessary for oil and gas operations. Techniques such as forging, casting, welding, and machining are commonly employed.

Illustrative image related to oil and gas field development

-

Forging: This involves shaping metal using localized compressive forces, which enhances the material’s strength. It is particularly useful for creating components like valves and fittings.

-

Casting: This method involves pouring molten metal into a mold to form parts such as pump housings and compressor bodies.

-

Welding: Essential for joining components, welding ensures structural integrity and is vital for pipeline construction and rig assembly.

-

Machining: Precision machining is used to create detailed components with tight tolerances, such as flanges and connectors, ensuring they fit seamlessly within the overall system.

Each of these processes requires adherence to strict quality standards to ensure durability and performance in demanding environments.

How Is Assembly Conducted in Oil and Gas Field Development Manufacturing?

The assembly stage integrates various components into functional systems. This stage is highly collaborative and typically involves cross-functional teams consisting of engineers, technicians, and project managers.

Assembly can occur in controlled environments or on-site, depending on the complexity and scale of the project. For instance, large structures such as drilling rigs may be partially assembled at a manufacturing facility before being transported to the site for final assembly.

Quality control during this phase is crucial, with inspections conducted at various checkpoints to ensure that all components are correctly installed and function as intended. This may involve using specialized tools and techniques, such as torque testing for bolted connections and pressure testing for pipes.

What Finishing Processes Are Essential for Oil and Gas Equipment?

Finishing processes enhance the performance and aesthetic qualities of the manufactured products. This may include surface treatments, coatings, and painting to protect against corrosion, especially in offshore applications.

Illustrative image related to oil and gas field development

Common finishing techniques include:

-

Coating: Applying protective layers to components to prevent corrosion, especially in environments with high humidity and saltwater exposure.

-

Painting: Not only for aesthetic purposes but also for additional protection against environmental factors.

-

Quality Inspections: Final inspections ensure that the products meet all specifications and regulatory requirements before they are shipped to the field.

What International Standards Guide Quality Assurance in Oil and Gas Manufacturing?

Quality assurance in oil and gas field development is governed by various international standards that ensure the safety, reliability, and efficiency of operations. Prominent among these are ISO 9001, which focuses on quality management systems, and industry-specific standards such as API (American Petroleum Institute) specifications.

ISO 9001 provides a framework for continuous improvement and customer satisfaction, making it a vital standard for manufacturers. API standards, on the other hand, offer specific guidelines tailored to the oil and gas sector, covering aspects from equipment design to operational practices.

What Are the Key Quality Control Checkpoints in Oil and Gas Manufacturing?

Quality control (QC) is integral to the manufacturing process, ensuring that products meet the required specifications and standards at different stages. Key QC checkpoints include:

-

Controllo qualità in entrata (CQI): This involves inspecting raw materials upon arrival to verify they meet quality specifications before they enter the production process.

-

Controllo qualità in corso d'opera (IPQC): Conducted during the manufacturing stages, IPQC ensures that processes are maintained within specified limits to prevent defects.

-

Controllo qualità finale (CQC): This final inspection checks the finished products against specifications and standards before they are shipped to the client.

Come possono gli acquirenti B2B verificare il controllo qualità dei fornitori?

B2B buyers can take several steps to verify the quality control processes of their suppliers:

-

Audits: Regular audits of suppliers can provide insight into their quality management systems and adherence to international standards. Buyers should request audit reports and certifications.

-

Rapporti sulla qualità: Suppliers should provide detailed quality reports that outline their processes, test results, and compliance with standards.

-

Ispezioni di terzi: Engaging independent third-party inspectors can provide an unbiased assessment of the supplier’s quality assurance practices, ensuring adherence to industry standards.

-

Certificazioni: Buyers should look for suppliers that hold relevant certifications, such as ISO 9001 and API certifications, indicating their commitment to quality.

What Are the Quality Control Nuances for International B2B Buyers?

International buyers, particularly those from diverse regions such as Africa, South America, the Middle East, and Europe, must navigate various quality control nuances.

Illustrative image related to oil and gas field development

Different regions may have specific regulatory requirements and standards, which can affect procurement strategies. For example, European buyers may prioritize CE marking, while Middle Eastern buyers may focus on compliance with local regulations.

Understanding these nuances is essential for ensuring that suppliers can meet both regional and international quality standards. Additionally, buyers should consider the logistical aspects of quality assurance, including transportation and storage conditions, which can impact product integrity.

In conclusion, the manufacturing processes and quality assurance practices in oil and gas field development are pivotal in ensuring the successful delivery of projects. By understanding these processes and implementing robust quality control measures, B2B buyers can mitigate risks and enhance operational efficiency in their supply chains.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘oil and gas field development’

Introduzione

This practical sourcing guide provides a step-by-step checklist for B2B buyers engaged in oil and gas field development. It aims to streamline the procurement process, ensuring that buyers can effectively identify, evaluate, and collaborate with suppliers to maximize efficiency and minimize risks in their projects.

Illustrative image related to oil and gas field development

Fase 1: Definire le specifiche tecniche

Before initiating the procurement process, it’s essential to have a clear understanding of your technical requirements. This includes defining the type of oil field development needed, the technology and equipment specifications, and the expected outcomes.

– Considerations:

– Identify the geological characteristics of the field.

– Specify the production targets and timelines.

Fase 2: Condurre ricerche di mercato

Thorough market research is vital to understand the landscape of suppliers and technologies available in the oil and gas sector. This step allows you to identify potential vendors, gauge market trends, and benchmark costs.

– Action Items:

– Review industry reports and case studies from similar projects.

– Network with industry experts and attend relevant trade shows for insights.

Fase 3: Valutare i potenziali fornitori

Before committing, it’s crucial to vet suppliers thoroughly. Request company profiles, case studies, and references from buyers in a similar industry or region. Don’t just rely on their website.

– Key Factors:

– Assess the supplier’s track record with similar projects.

– Verify their financial stability and capacity to handle large-scale developments.

Passo 4: Request Proposals and Quotes

Once you have a shortlist of suppliers, request detailed proposals and quotes. This not only helps you compare costs but also allows you to assess the suppliers’ understanding of your project requirements.

– What to Look For:

– Ensure proposals include timelines, milestones, and deliverables.

– Analyze the breakdown of costs to identify any hidden fees.

Illustrative image related to oil and gas field development

Passo 5: Verifica delle certificazioni e della conformità

Ensuring that suppliers comply with industry standards and regulations is crucial for safety and quality. Verify their certifications and adherence to local and international regulations.

– Important Checks:

– Look for ISO certifications relevant to oil and gas operations.

– Confirm compliance with environmental regulations and safety standards.

Passo 6: Negoziare termini e condizioni

Negotiating favorable terms is essential for protecting your interests. This includes pricing, payment schedules, delivery timelines, and service agreements.

– Negotiation Tips:

– Be clear about your expectations and requirements.

– Aim for a win-win outcome to build a long-term partnership.

Passo 7: Establish a Monitoring and Evaluation Framework

After selecting a supplier, set up a framework to monitor progress and evaluate performance throughout the project lifecycle. This ensures that any issues can be addressed promptly.

– Framework Components:

– Define key performance indicators (KPIs) for quality and efficiency.

– Schedule regular check-ins and progress reports to stay aligned with project goals.

By following this checklist, B2B buyers can enhance their sourcing strategy, ensuring a smoother procurement process for oil and gas field development projects.

Comprehensive Cost and Pricing Analysis for oil and gas field development Sourcing

What Are the Key Cost Components in Oil and Gas Field Development?

When analyzing the cost structure of oil and gas field development, several critical components need to be considered:

-

I materiali: This includes the cost of drilling equipment, pipes, pumps, and other essential materials. The price can fluctuate based on market demand and supplier availability. High-quality materials may command a premium, but investing in them can minimize long-term operational risks.

-

Lavoro: Skilled labor is essential in every phase, from exploration to decommissioning. Labor costs vary significantly across regions. For example, labor in Europe may be more expensive compared to Africa, but the skill level and expertise can differ as well.

-

Spese generali di produzione: This encompasses indirect costs associated with production, such as utilities, facility maintenance, and administrative expenses. Understanding these costs can provide insights into the overall pricing structure.

-

Utensili: The costs of specialized tools and equipment for drilling and extraction must be factored in. These tools often require significant upfront investment, which can impact the overall budget.

-

Controllo qualità (CQ): Ensuring that all materials and processes meet industry standards incurs costs that can vary based on the complexity of the project and regulatory requirements. Investing in QC can prevent costly delays and rework.

-

Logistica: Transportation of materials and equipment to remote locations can be a significant expense. Effective logistics planning can reduce these costs and ensure timely delivery, which is critical for maintaining project timelines.

-

Margine: Suppliers typically include a margin in their pricing to account for risk, profit, and overhead. Understanding the typical margins in the industry can aid buyers in negotiations.

How Do Price Influencers Affect Oil and Gas Field Development Costs?

Several factors influence pricing in oil and gas field development:

-

Volume e quantità minima d'ordine (MOQ): Larger orders often result in better pricing due to economies of scale. Buyers should consider consolidating orders to leverage volume discounts.

-

Specifiche e personalizzazione: Custom requirements can increase costs. Clearly defining specifications upfront can help avoid unexpected expenses and delays.

-

I materiali: The choice of materials directly impacts the overall cost. Buyers should consider the long-term implications of material selection on maintenance and operational efficiency.

-

Qualità e certificazioni: Higher quality materials and certified suppliers typically come at a premium. However, they can lead to reduced risk of failure and lower maintenance costs over time.

-

Fattori di fornitura: Supplier reputation, reliability, and financial stability can influence pricing. Conducting thorough supplier evaluations can mitigate risks associated with cost overruns and delays.

-

Incoterms: Understanding the terms of delivery can significantly affect costs. Different Incoterms dictate who bears the risk and costs at various stages of shipping, impacting the overall financial outlay.

What Negotiation Strategies Can Buyers Use to Ensure Cost Efficiency?

For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, several negotiation strategies can enhance cost efficiency:

-

Costo totale di proprietà (TCO): Assessing the TCO, which includes initial costs, operational costs, and end-of-life costs, can provide a clearer picture of the true expense of procurement decisions.

-

Leverage Market Research: Understanding market trends and pricing benchmarks can empower buyers during negotiations, enabling them to argue for more favorable terms.

-

Costruire relazioni a lungo termine: Establishing strong relationships with suppliers can lead to better pricing, priority service, and flexibility in contracts, especially during negotiations for future projects.

-

Considerate i fornitori locali: Engaging local suppliers can reduce shipping costs and lead times, while also potentially qualifying for local content incentives and regulations.

What Should Buyers Know About Pricing Nuances in International Markets?

Buyers in different regions may encounter unique pricing dynamics:

-

Currency Fluctuations: Exchange rates can impact costs, particularly for international transactions. Buyers should monitor currency trends and consider hedging strategies when appropriate.

-

Conformità normativa: Understanding local laws and regulations can prevent unexpected costs. Compliance can vary significantly across regions, influencing both direct and indirect costs.

-

Considerazioni culturali: Different regions have distinct negotiation styles and practices. Being culturally aware can facilitate smoother negotiations and foster stronger partnerships.

Disclaimer on Indicative Prices

Due to the fluctuating nature of the oil and gas market, the prices and cost estimates provided in this analysis are indicative only. Buyers should conduct their own research and consult with industry experts to obtain the most accurate and relevant pricing information tailored to their specific projects.

Alternatives Analysis: Comparing oil and gas field development With Other Solutions

Introduction: What Are the Alternatives to Oil and Gas Field Development?

In the evolving energy landscape, businesses must consider various approaches to meet their energy needs. While traditional oil and gas field development remains a cornerstone of energy production, emerging alternatives present compelling options. Understanding these alternatives can help B2B buyers make informed decisions that align with their operational goals, financial constraints, and sustainability commitments.

Illustrative image related to oil and gas field development

Comparison Table: Evaluating Oil and Gas Field Development Against Alternatives

| Aspetto di confronto | Oil And Gas Field Development | Renewable Energy Projects | Enhanced Oil Recovery (EOR) |

|---|---|---|---|

| Prestazioni | High initial output but declining over time | Variable output based on resource availability | Increases output from existing fields |

| Costo | High capital investment and ongoing operational costs | Lower long-term costs but high initial setup | Moderate costs with potential for high returns |

| Facilità di implementazione | Complex, lengthy, and heavily regulated | Varies by technology; generally requires significant planning | Requires existing infrastructure; less complex than new fields |

| Manutenzione | High maintenance demands; requires skilled labor | Lower maintenance; technology-specific | Moderate maintenance; ongoing monitoring needed |

| Il miglior caso d'uso | High-demand energy markets | Sustainable energy goals, remote areas | Mature fields seeking to extend life and recover more resources |

Ripartizione dettagliata delle alternative

Renewable Energy Projects

Renewable energy projects, such as solar and wind farms, provide a sustainable alternative to traditional oil and gas development. They offer lower long-term operational costs and contribute to environmental sustainability. However, their performance can be variable, heavily influenced by weather conditions and geographic location. The initial capital investment may also be substantial, making it a significant consideration for businesses that require immediate energy solutions.

Enhanced Oil Recovery (EOR)

Enhanced Oil Recovery techniques, including thermal recovery and gas injection, aim to extract additional oil from existing fields. This method capitalizes on established infrastructure, allowing companies to increase output without the costs associated with new drilling. EOR can be a cost-effective solution for mature fields but requires ongoing investment in technology and monitoring. While it enhances production efficiency, it still relies on fossil fuel extraction, which may not align with sustainability goals.

Conclusion: How Can B2B Buyers Choose the Right Energy Solution?

Choosing the right energy solution involves assessing various factors, including performance expectations, cost constraints, and long-term sustainability goals. B2B buyers should consider their operational requirements and market dynamics when evaluating alternatives to oil and gas field development. Whether opting for traditional methods or exploring innovative technologies, a strategic approach tailored to specific needs will ensure optimal energy management and business growth.

Essential Technical Properties and Trade Terminology for oil and gas field development

What Are the Critical Technical Properties in Oil and Gas Field Development?

In the oil and gas sector, understanding key technical specifications is crucial for ensuring that projects meet performance and safety standards. Here are several critical technical properties that B2B buyers should be familiar with:

-

Grado del materiale

This refers to the quality and type of materials used in construction and equipment, such as steel grades for pipelines and tanks. The right material grade is essential for durability and resistance to corrosion, especially in harsh environments. Selecting the appropriate material can significantly affect the longevity and safety of the infrastructure. -

Pressione nominale

This specification indicates the maximum pressure that equipment can handle without failure. For instance, drilling rigs and pipelines must be rated for the high pressures encountered in deep wells. Understanding pressure ratings helps in choosing suitable equipment and ensuring compliance with safety regulations, reducing the risk of accidents. -

Tolerance Levels

Tolerance levels define the acceptable variation in dimensions for manufactured components. In oil and gas applications, precise tolerances are critical for ensuring that parts fit together correctly, especially in high-stakes environments where failures can lead to significant financial losses or safety hazards. -

Thermal Conductivity

This property measures a material’s ability to conduct heat, which is crucial in processing facilities where temperature control is vital. Effective thermal management can enhance energy efficiency and process safety, making it an important consideration during equipment selection. -

Flow Rate

Flow rate is the volume of fluid that can be transported through a pipeline or equipment per unit time. Understanding flow rates is essential for optimizing production and ensuring that the system can handle the expected output. Buyers must consider flow rates when designing infrastructure to avoid bottlenecks in production.

What Are Common Trade Terms Used in Oil and Gas Field Development?

Navigating the oil and gas industry involves understanding specific jargon that streamlines communication among stakeholders. Here are some common trade terms:

-

OEM (Original Equipment Manufacturer)

An OEM is a company that produces parts or equipment that may be marketed by another manufacturer. In oil and gas, OEMs provide critical components for drilling rigs, pumps, and other machinery. Understanding OEM relationships helps buyers ensure quality and reliability in their supply chains. -

MOQ (quantità minima d'ordine)

MOQ refers to the smallest quantity of a product that a supplier is willing to sell. This term is vital for buyers to understand when negotiating contracts, as it affects inventory management and cost efficiency. Knowing the MOQ helps in planning purchases to avoid excess stock or shortages. -

RFQ (Richiesta di offerta)

An RFQ is a document sent to suppliers to solicit pricing and terms for specific goods or services. Issuing an RFQ allows buyers to compare offers from multiple vendors, promoting competitive pricing and ensuring they make informed decisions. -

Incoterms (Termini commerciali internazionali)

These are predefined commercial terms published by the International Chamber of Commerce, which clarify the responsibilities of buyers and sellers in international transactions. Familiarity with Incoterms is essential for understanding shipping costs, risk transfer, and delivery obligations, helping to mitigate misunderstandings in contracts. -

FPSO (Floating Production Storage and Offloading)

FPSO units are offshore vessels used for the processing and storage of oil and gas. They play a crucial role in deepwater oil field development. Understanding FPSOs is important for buyers involved in offshore projects, as they represent significant capital investment and operational complexity.

By grasping these technical properties and trade terms, B2B buyers can make more informed decisions in the oil and gas field development process, ultimately leading to more successful project outcomes.

Navigating Market Dynamics and Sourcing Trends in the oil and gas field development Sector

What Are the Current Market Dynamics and Key Trends in Oil and Gas Field Development?

The oil and gas field development sector is currently experiencing transformative changes driven by several global factors. First, the demand for energy continues to surge, particularly in emerging markets across Africa and South America, where economic growth is accelerating. Additionally, geopolitical tensions and fluctuating oil prices are pushing companies to adopt agile strategies to remain competitive. The integration of advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and data analytics is becoming commonplace, enabling companies to optimize exploration and production processes while enhancing decision-making capabilities.

International B2B buyers are increasingly focused on digital transformation in their sourcing strategies. The use of digital platforms for procurement and supply chain management is on the rise, allowing for greater transparency and efficiency. Moreover, there is a noticeable shift towards collaborative partnerships as companies seek to leverage each other’s strengths in technology and local market knowledge, particularly in regions like the Middle East and Europe. These collaborations are vital in navigating the complexities of regulatory environments and local content requirements, especially in countries like Nigeria and Germany.

How Does Sustainability and Ethical Sourcing Impact Oil and Gas Field Development?

In recent years, sustainability has emerged as a critical consideration in oil and gas field development. The environmental impact of oil extraction has led to increased scrutiny from stakeholders and regulatory bodies. Companies are now prioritizing ethical sourcing practices to mitigate risks associated with environmental degradation and social responsibility. This trend is particularly relevant in regions where local communities are directly affected by oil field operations.

Sourcing ‘green’ materials and technologies is becoming a competitive advantage. The adoption of eco-friendly drilling fluids, energy-efficient equipment, and waste management solutions is not only beneficial for the environment but also enhances corporate reputation and compliance with international standards. Certifications such as ISO 14001 for environmental management systems and participation in initiatives like the United Nations Global Compact are becoming essential for companies aiming to demonstrate their commitment to sustainability. B2B buyers are advised to evaluate suppliers based on their sustainability credentials, ensuring that their supply chains align with ethical and environmental standards.

What Is the Brief Evolution of Oil and Gas Field Development?

The oil and gas field development sector has evolved significantly over the past century. Initially dominated by conventional drilling techniques, the industry saw a paradigm shift with the advent of advanced technologies in the late 20th century. The introduction of horizontal drilling and hydraulic fracturing revolutionized extraction methods, enabling access to previously unreachable reserves.

In recent years, the focus has shifted towards optimizing production through digital innovation and sustainability initiatives. The integration of big data analytics, automation, and remote monitoring systems has transformed operational efficiencies, allowing companies to respond swiftly to market dynamics. As the industry continues to adapt to global challenges, including climate change and energy transition, the evolution of oil and gas field development remains a critical area for B2B engagement and investment.

Illustrative image related to oil and gas field development

Frequently Asked Questions (FAQs) for B2B Buyers of oil and gas field development

-

How do I evaluate the feasibility of an oil field development project?

To evaluate the feasibility of an oil field development project, start with a comprehensive feasibility study that includes geological assessments, economic viability, and environmental impact evaluations. Engage geophysicists and petroleum engineers to estimate potential yield and production costs. Analyze market conditions and regulatory requirements in the target region. Consider the technological capabilities and expertise of your team or partners. A detailed report will help stakeholders make informed investment decisions, ensuring that the project aligns with both financial goals and operational capabilities. -

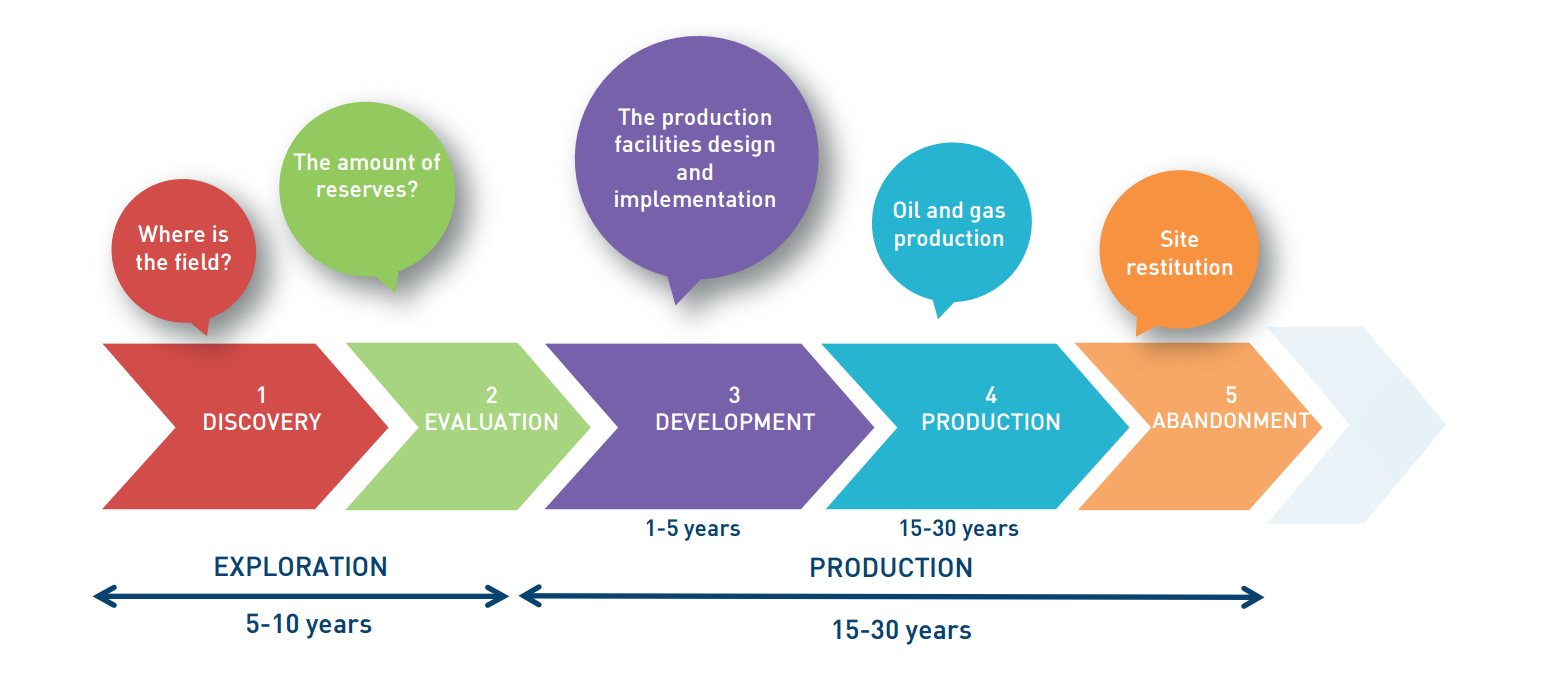

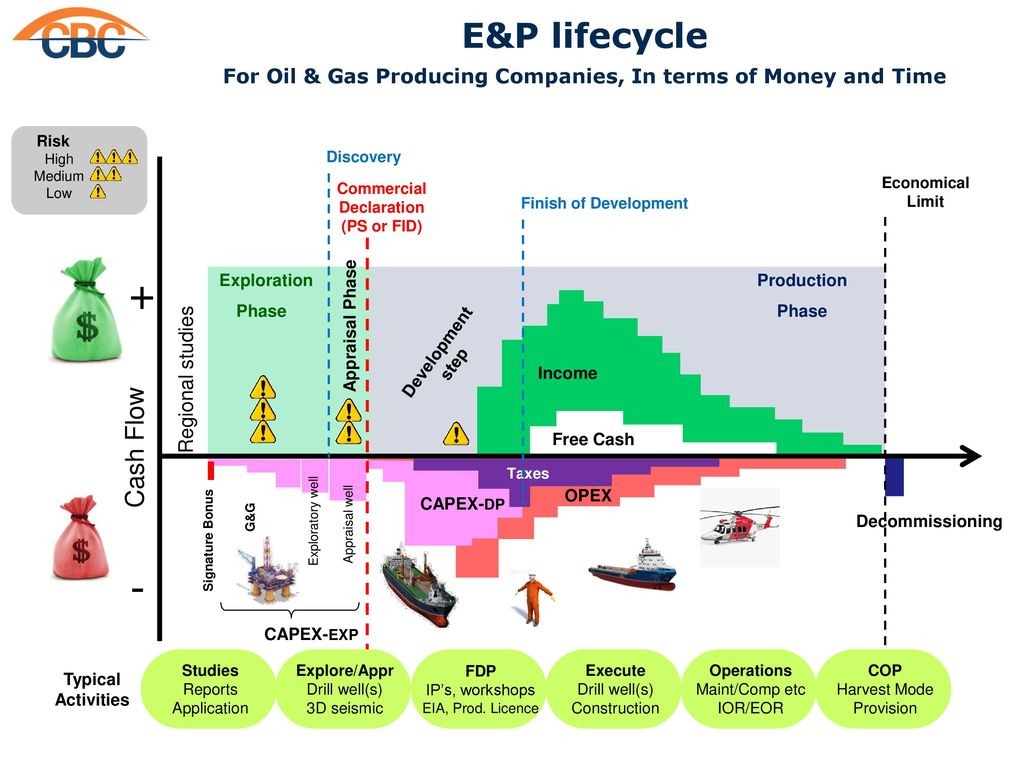

What are the key stages in oil field development that I should be aware of?

Oil field development typically involves several critical stages: exploration and appraisal, feasibility studies, frontend engineering, detailed design and procurement, construction and inspection, installation and commissioning, production and maintenance, and finally, decommissioning and abandonment. Each stage requires specialized skills and meticulous planning to optimize costs, timelines, and resource allocation. Understanding these stages helps you identify the necessary expertise and resources for successful project execution, minimizing risks and maximizing returns. -

What is the typical timeline for oil field development projects?

The timeline for oil field development varies significantly based on location, project scope, and regulatory environment. Generally, a project can take anywhere from a few months to several years from exploration to production. Factors like the complexity of the geological formation, environmental assessments, and permitting processes can extend timelines. Establishing a clear project plan with milestones and regular progress reviews helps keep the development on track and ensures timely decision-making. -

How do I vet suppliers for oil field development projects?

Vetting suppliers for oil field development is crucial for project success. Begin by assessing their industry experience, reputation, and financial stability. Request references and case studies from previous clients to evaluate their performance and reliability. Ensure they comply with local and international regulations, and check certifications for quality assurance. Conduct site visits or interviews to assess their operational capabilities and commitment to safety standards. A thorough vetting process minimizes risks and fosters successful long-term partnerships. -

What customization options should I consider for oil field equipment?

When sourcing oil field equipment, consider customization options that enhance operational efficiency and meet specific project requirements. This may include tailored drilling rigs, specialized pumping systems, or storage solutions designed for local environmental conditions. Discuss your unique needs with suppliers to identify adaptable technologies that align with your operational goals. Customization can improve performance, reduce costs, and extend the lifespan of the equipment, making it a critical factor in procurement decisions. -

What are the minimum order quantities (MOQs) for oil field development equipment?

Minimum order quantities (MOQs) for oil field development equipment vary by supplier and product type. Some suppliers may have flexible MOQs for specialized equipment, while others may require larger orders to maintain cost-effectiveness. When negotiating, consider your project scale and future needs to ensure that you secure the right quantity without overcommitting. Discuss potential discounts for bulk orders or establish a phased procurement strategy to manage costs effectively while ensuring timely availability of necessary resources. -

What payment terms are common in the oil and gas industry?

Payment terms in the oil and gas industry can differ based on the supplier’s policies, project scale, and regional practices. Common terms include upfront deposits, milestone payments tied to project phases, and final payments upon completion or delivery. Negotiate terms that align with your cash flow and project timelines. Consider including clauses for penalties or incentives based on performance to ensure accountability. Clear payment agreements foster strong relationships and help manage financial risks throughout the project lifecycle. -

How do I ensure quality assurance during the oil field development process?

To ensure quality assurance (QA) during oil field development, establish a comprehensive QA plan that includes regular inspections, testing protocols, and compliance checks at each project stage. Collaborate with experienced engineers and quality control specialists to develop standards that meet industry regulations and best practices. Implement real-time monitoring systems to track performance and identify issues early. Documentation of all QA processes is essential for accountability and helps maintain transparency with stakeholders and regulatory bodies.

Top 4 Oil And Gas Field Development Manufacturers & Suppliers List

1. ScienceDirect – Oil Field Development Strategies

Dominio: sciencedirect.com

Registrato: 1997 (28 anni)

Introduzione: Oil field development involves optimizing production through processes such as drilling new wells, modifying existing well layers, and implementing treatment strategies to adapt to production conditions. Key challenges include nonlinearity, nonconvexity, complex dynamics, model size, and uncertainty. Opportunities exist in offshore installation planning, EOR planning, complex well design, and unce…

2. Oil & Gas Portal – Field Development Plans

Dominio: oil-gasportal.com

Registrato: 2014 (11 anni)

Introduzione: Field Development Plans (FDPs) support field optimization and include activities such as environmental impact assessment, geophysics, geology, reservoir and production engineering, infrastructure, well design and construction, completion design, surface facilities, economics, and risk assessment. The development phase involves geologists, geophysicists, reservoir engineers, drilling engineers, pro…

3. LLOG Exploration – Leon-Castile Fields

Dominio: upstreamonline.com

Registrato: 2000 (25 anni)

Introduzione: LLOG Exploration’s Leon-Castile fields in the US Gulf achieved first oil, flowing to the Salamanca hub.

4. Ferasa – Oil and Gas Field Development

Dominio: ferasa.net

Registered: 2006 (19 years)

Introduzione: The main steps of an oil or gas field development project include: 1. Exploration and Evaluation – Field discovery through seismic echography and drilling exploration wells; 2. Field evaluation using 3D numerical reservoir simulation models and appraisal wells; 3. Field development planning, including the number of wells, recovery techniques, installation types and costs; 4. Field production, whic…

Strategic Sourcing Conclusion and Outlook for oil and gas field development

In the rapidly evolving landscape of oil and gas field development, strategic sourcing emerges as a pivotal factor in optimizing project success. By meticulously navigating the phases from exploration to decommissioning, B2B buyers can leverage specialized skills and innovative technologies to enhance efficiency and reduce costs. The importance of selecting reliable vendors and ensuring rigorous quality control cannot be overstated; these elements are crucial in maintaining operational integrity and meeting environmental regulations.

As we look ahead, the global demand for energy continues to rise, presenting lucrative opportunities for international buyers, particularly in regions like Africa, South America, the Middle East, and Europe. By adopting a proactive approach to strategic sourcing, organizations can not only mitigate risks associated with supply chain disruptions but also drive sustainable practices that align with global standards.

To capitalize on these opportunities, buyers should invest in building strong partnerships with experienced suppliers and stakeholders. As the industry progresses, staying ahead of technological advancements and market trends will be essential. Engage with your suppliers today to ensure your projects are not just successful but also future-ready.

Illustrative image related to oil and gas field development

Disclaimer importante e condizioni d'uso

⚠️ Disclaimer importante

Le informazioni fornite in questa guida, compresi i contenuti relativi ai produttori, alle specifiche tecniche e all'analisi di mercato, hanno uno scopo puramente informativo ed educativo. Non costituiscono una consulenza professionale in materia di acquisti, né una consulenza finanziaria o legale.

Pur avendo compiuto ogni sforzo per garantire l'accuratezza e la tempestività delle informazioni, non siamo responsabili di eventuali errori, omissioni o informazioni non aggiornate. Le condizioni di mercato, i dettagli aziendali e gli standard tecnici sono soggetti a modifiche.

Gli acquirenti B2B devono condurre una due diligence indipendente e approfondita. prima di prendere qualsiasi decisione di acquisto. Per questo è necessario contattare direttamente i fornitori, verificare le certificazioni, richiedere campioni e chiedere una consulenza professionale. Il rischio di affidarsi alle informazioni contenute in questa guida è esclusivamente a carico del lettore.